Time. You never understand how precious it is until you get older and older. As each year passes, you realize more and more how fast a year goes by.

I grew up moving from state to state from 8th grade through my senior year in high school. We went from one extreme in location to the next.

During all of the moving, confusion, and heartaches, one thing stayed constant for me. I wanted success. As an 18-year-old, I wanted a career in journalism. I saw myself walking down the streets of NYC. I saw independence and money.

Success to me was living a rich life that society had defined.

Or so I thought, as most 18-year-olds do.

I’m so incredibly grateful for opening my heart to God’s path and not that 18-year-old one.

Because now, 20 years later, I’ve achieved so much more of my life goals than I ever imagined I could.

I grew up hearing all about saving money and how much things cost. Taking a long shower never happened in our house. The hilarious phrase- “You’re eating us out of house and home.”

It was a recurrent thing. I know I’m not the only one who heard this.

We grew up always just scraping by. And although my parents did the best they could, I knew I never wanted to worry about paying for groceries.

That was my thing. I didn’t want to have to tell my kids not to eat that. Or only eat this much because I couldn’t afford it.

Things were like that when my husband and I started our debt-free journey. Tight. Paycheck to paycheck.

But even during college, we were fine with living on less. I never needed new clothes or anything fancy. Aldi Chicken dinners for $0.89 were our go-to. I mean, can you believe that price?

As we come to the summer months and the continuing rising food costs, I can feel my old frugal cheap self wanting to tell my kids NO, don’t eat that. Save it.

But I don’t have to.

Because being frugal all those years and thinking about every financial decision has led us to a debt-free amazing life. Which is my own “rich life.”

What does your rich life look like?

We started our debt-free journey small. Then I started my blog, and it started off small. That deep desire I had as a teen for success shifted to a desire to start a blog and retire my husband before the typical retirement age of 65.

I started blogging back in 2015. It was at a time when blogging was really taking off. You could find many blogging income reports and bloggers having the goal of retiring their husbands or having their husbands blog with them.

It became a goal and maybe a slight obsession, and it still is. The astonishing thing is, I could retire my husband with my blogs, BUT it’s not God’s timing yet. And that is the most important thing during our frugal living, debt-free journey. Following God’s plan.

It’s funny when people meet me out and about, and they have an idea about who I am from my blogs or maybe what they’ve heard others say.

When I started blogging, I was broke and needed every deal. It’s different when you still shop at Goodwill, even when it’s not a have-to.

Followers on Tiktok will assume you are broke if you shop at Goodwill. They don’t understand that brand-new clothes and the latest trend don’t singly excite me. I would rather spend money to travel and go on vacation.

So let’s remember what does YOUR own unique rich life look like? What would financial freedom look like for you?

For me right now, it’s no mortgage payment, no debt, money in savings, money for retirement, and my blogs continuing to bring in cash.

Are you ready to get started on a debt-free journey?

Write out your financial goals- maybe it is to pay off debt. Maybe it’s to save for a house. Maybe it’s to have money in a savings account.

Whatever you need for your current situation and family.

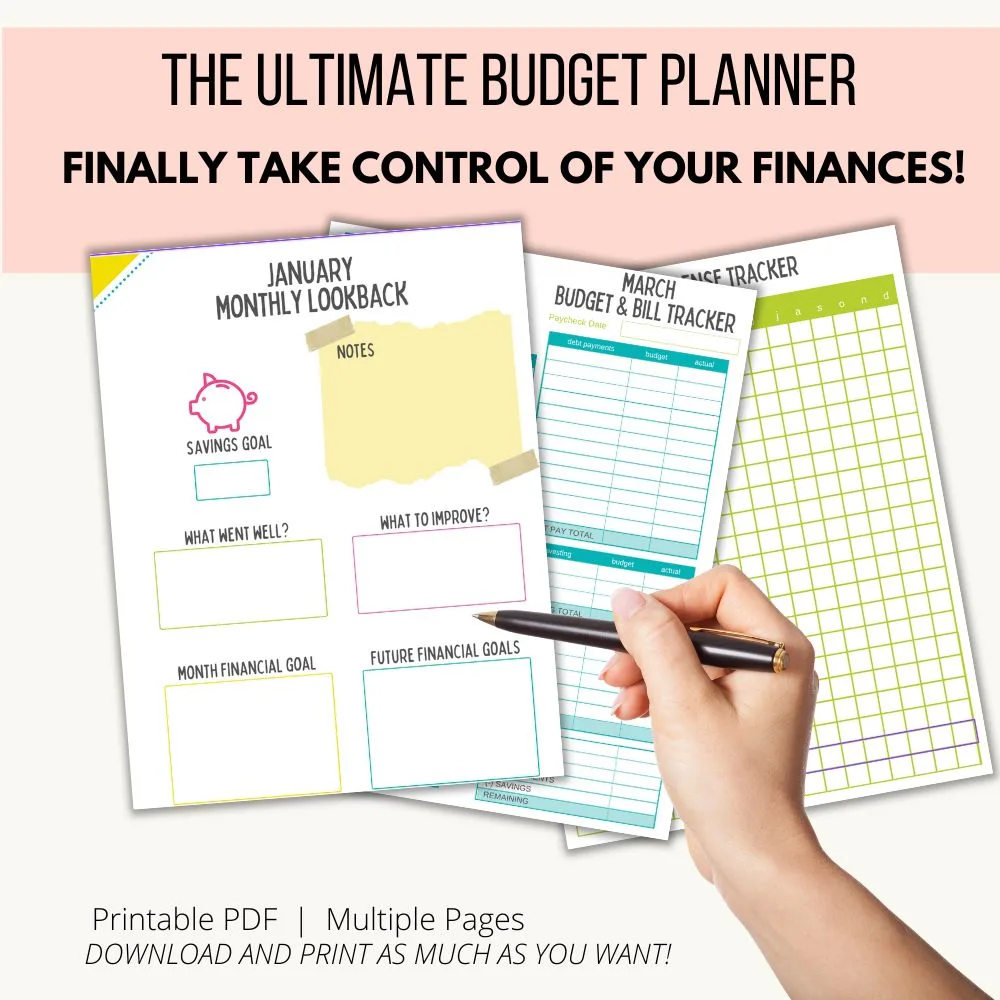

Write it down and then figure out how to get there. You have to look at your spending and create a budgeting binder.

Let’s say your goal is to pay off credit cards.

Also write in dates you want to achieve these goals. If you plan to pay off your credit cards in a few months, you won’t stick with it.

You need to make SHORTER time frames so that you are challenged to get it done. For example, if you have $300 in savings and you have a $250 credit card balance, pay it off now. Why wait?

I remember back in our early debt-free days, reading about others who could afford expensive things and would still choose to shop secondhand. I felt mad and offended. Like why are they taking what those of us need?

But you can’t be like that because we all make our own decisions. Getting something for less than what it’s priced at or worth will always be instant gratification for me. And choosing to buy used over new is a smart financial decision.

And that’s another key to living a successful frugal life.

You have to keep your financial priorities in line. Whats your first goal? How will you get there?

Is it to pay off one credit card? Then another?

Is it to pay off the car loan? Maybe it’s not to put your grocery bill on a credit card.

They key is to make one small goal and achieve it. Give it EVERYTHING you got. And keep in mind that when you reach that goal, you’ll be able to do it for the next and the next.

And then, 20 years later, you’ll find financial freedom.

The next thing most people don’t think frugal people have is a rental home. Oh my, that will be a whole blog post another day. But it’s been something my husband and I felt we could handle and achieve. After praying about it for two years, we finally purchased one.

Just like starting your own blog, it’s not for the faint of heart.

When things get tough, you can NOT throw in the towel. It may FEEL like it’s easier to go back to how it was or live with paying off the minimum on the credit card, but you HAVE to get through those first-time pains. They will not hurt as bad the next time.

It’s always uncomfortable when we start to pay off debt. Our minds want to tell us this is silly, we could use that money right now for __ fill in the blank.

It happened with the rental house for me again. I wanted to get rid of it and sell it.

But I’m forgetting about the long-term goal. And then I’m reminded about this blogging experience and the whole debt-free journey, and it’s always been a long-term goal with HUGE rewards.

When we paid off our mortgage, I started with Tiktok. Mostly I was bored at home and wanted to get new traffic to my blog. I had so much fun with it. I hope I can feel that way again; I’ve almost lost my desire to post on it completely.

IT WAS PRETTY CONTROVERSIAL when I shared how we paid off our mortgage in four years. I get it. I see it from both sides.

But the one thing I can tell you today is it was the right decision for us. I knew that if God was telling us this is what to do, we had to go through with it.

Having no mortgage and no debt is part of what our own rich life looks like. It’s okay if your rich life doesn’t include paying off a mortgage; maybe your rich life is you will rent because you don’t want the extra maintenance and the freedom to travel.

So before you start feeling defeated about your own financial goals, really be still and let your soul have a chance to think about what you want out of life. If you have a spouse, ask them about their own rich life. Then bring the dreams together.