Did you realize if you can cut back $10 a day, you’ll save $300 a month?! That’s $3,600 a year! If you start looking at the small daily expenses you will find immediate ways to save money.

6 Things to Cut From Your Budget Today

Ready to Drink Beverages

This means coffee at Starbucks, Tim Hortons, Dunkin even the gas station—alcoholic beverages at dinner. Even buying beer from the store is a place to cut back. Soda, energy drinks, and bottled water can all be excluded from your grocery list.

You think you aren’t spending a lot when you buy things that may only cost $2 at a time. However, when you look at your budget and see that you bought two energy drinks five days a week at $3 each, you just spent $15 on drinks. That’s $60 a month, which can easily be your cable bill or cell phone bill.

Anything that is a drink prepared for you- is not a need and can be cut from the budget.

Haircuts

If you figure kids’ haircuts are, on average, $25, a women’s cut is around $50, and Dad squeaks by at $30. A family of five at this price is $155, and do you go every three months? That is $620 a year on haircuts.

If you have boys, you can buy an affordable buzzer and give them a cut yourself. Youtube videos are all over, teaching you how to cut your kid’s hair.

Even if you can’t afford your regular stylist, you could take the chance at Supercuts for $18 on average plus a tip; still, this is an expense you can cut out while you catch up on bills/ debt. Go longer between cuts if you can’t DIY.

I’ve been cutting and coloring my own hair for years now. For the last year and a half, I’ve been using esalon. They customize the color for you, and it gets shipped to you. I like setting it to every eight weeks and knowing when it shows up; it’s time to color and trim my hair.

This year 2023, I grabbed the Highlighting kit from Esalon and loved it! Easy to use.

This is the video I use to cut my hair and my girl’s hair, plus add layers to my hair.

Pre-made foods

If you need to save money fast, eliminating going out to eat should be number one, but that’s not that silly, is it? It’s obvious. If you decide not to eat out for an entire month, you may be tempted to buy the prepacked dinner meals at your grocery store.

Skip it. That premade lasagna costs you $15; you can make it at home for less. Depending on your family size, you may even get two meals out of it.

Try one of the Frugal Snacks you can make at Home HERE.

There are always deals on noodles and pasta sauce. Challenge yourself to make any meal you typically buy at the store this month.

You don’t need fancy recipe books, just internet access, because there are an insane amount of incredible recipes to make anything you need online.

Can I say hello, Pinterest?!

( Follow my Frugal Meal Planning board here)

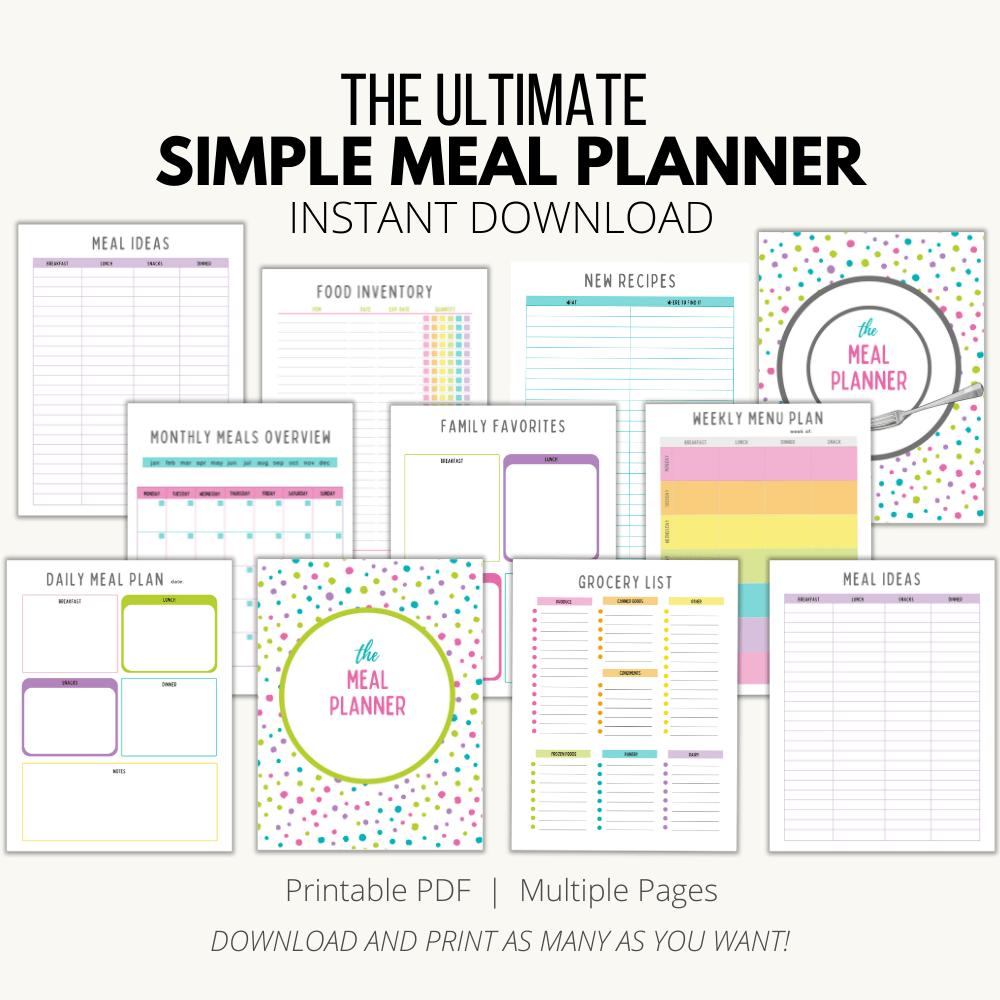

Grab my FAVORITE meal planning planner too; grab it right now as an instant download and use code Tiktok to get 50% OFF! That’s a deal, friends!

Get Rid of Services

Any lawn care, snow removal, get rid of. You may think you don’t have the time, but you will find the time if you prioritize saving money. So give it a shot to do it yourself.

If you physically can’t do it, see if a neighbor or a teenager can pick up one of the services you are paying for yourself.

Trash collection is another one. Call around and see if there is a cheaper one. I was surprised to do this myself and find out we had several options. Finally, look into taking your trash to the town/city recycling center.

The average in our area is $1.50- $2 a bag. This can be cheaper for those who don’t have a ton of garbage. This cost is usually less than the price of paying for a trash removal service.

Read or Pin: 6 Little Known Ways to Save Money – That Will Change Your Life

Get Rid of Extra Prime Services

You may not realize all those free trials you signed up for are still on your Prime Account. You may be able to get rid of your Prime Membership altogether. So should you be buying all those items through Amazon Prime, to begin with?

Look at the benefits of an Amazon Prime membership and figure out if it is worth the extra cost. When you add on extras like the Showtime channel or even Prime Pantry, you pay for it.

There is a good chance it is not worth the extra cost at this time while you are trying to pay down debt or catch up on bills.

You can watch so many shows on Youtube for free. Netflix is a cheaper alternative to cable and even Prime. Do you need an audible subscription? Go through your Prime account and cancel any extra services.

Go through all your extra streaming services and see if cable may be cheaper.

Then write down the services from Amazon you use daily. Is it worth the cost of $119 a year?

If you are looking for FREE baby items, check out this list that was a lifesaver for me during those late-night feedings.

Pet Treats/Salon Visits

Your sweet little one can go a month or two or three without a special treat. If you can’t be that cheap, again pull up Pinterest and search for homemade recipes to make your pet something special. Forget taking them to get groomed. You can do this yourself.

Utilize that bathtub and shampoo!

I encourage you to strive to save $10 a day, whether it’s from one of the above items mentioned or getting creative to things you can keep in your own home. If you have an extra $3,600 today, where would it go?

Remember always to visualize where every dollar is going and to keep your eye on the prize! Your end financial goal.

Carolyn

Tuesday 15th of January 2019

You have seriously underestimated the cost of haircuts. Boys and men usually get monthly haircuts, girls and women can go longer, usually 4-6 weeks with short hair and 8-12 weeks with long hair. When I figure in the costs of hubby being the family barber/stylist, I;calculated the boys at $15 each with tip and mine at $60 every three months, then there is transportation costs, about $30 per round trip for mileage and the loss of my time at about $50 for travel, wait time, and duration of haircuts. So over $1300 for the two boys and $640 for mine. Serious savings. Thankfully hubby is handy with the shears as well as the clippers. Boys get haircuts using different attachment lengths on the sides and the scissors over comb for their longer hair on top. He does their hair as they want and they trust him and like him work. There is no savings if the children refuse to let you cut their hair and it causes arguments because you can only shave their head and they feel embarrassed to go to school. My hair reaches my elbows and being hubby pampers me, I have him trim mine every other month. My ends grow uneven, so at the eight week point it is noticeable. He uses good shears, he capes me combs out my hair, sections it, and trims the layers in increments from my nape to my crown. Always a Great job, I wouldn’t have him do it if he was going to screw up my hair. I am picky about my looks, I won’t walk around with a wonky looking haircut or ask my children to. Two of my best friends and my mom have had him cut their hair for them. Free haircuts are great, only if they look good. We have an antenna on our house that gets local channels, no cable tv. We take coffee and water from our faucet at home to work and on trips. We avoid Starbucks, it tastes burnt anyway. We have a garden and I can and freeze fruits and vegetables, you cannot beat the taste of fresh fruits and vegetables as well as knowing they are not loaded with poisons. There is work involved in a garden though. Soil management, planting, watering, weeding, pruning and harvesting all take time and effort. We save, but there is sweat equity in those savings. We mow our lawn, shovel/clear our own driveway and change the oil in our vehicles. Hubby is also the chef, and he hates prepared foods, he believes in single ingredients combined to cook, cost per ounce is far less and there is no high fructose corn syrup, soybean oil or preservatives in his meals. He is a great cook, my mother will ask what he is making on the weekends and ask for an invitation, my sister does with her family for a couple holidays. I think a DIY, insource it attitude to manage your resources wisely is a must for every one. Frugal is that wise use of what you have and looking for ways to do things better without cutting corners.

Tasia

Wednesday 16th of January 2019

HI Carolyn! Boy, I guess I have. My husband always cuts his own hair and the girls and I usually go twice a year! For sure those expenses add up. Love hearing all the ways you and your family save. Thank you for stopping by :)

Ray Tetreault

Friday 11th of January 2019

I'm totally on board with giving up Prime... will YOU talk to my wife??? The only thing I like it for is because my Echo Dot plays from the Prime (standard) library although I could teach Alexa other tricks for free. We do NOT watch the Prime tv/movies. As for free shipping, it's not normally free... it's definitely included in higher prices. It is, however, cheaper than a divorce. Honestly, however, $119 a year is nickles and dimes compared to the other cuts we've made (several tips mentioned above) along with things that work for us that may not work for anyone else... too many to list... but a ballpark is over $1250 a month.

Imagine the two of us cutting our medication costs by over $100/mo, cable and "media" by $175, dining out with groupons and other "deal" sites to cut $20, reducing internet by $20, energy bill by $20, no more office lunches or vending machine trips at work for another $200 (um, each - $400/mo + tips), and ground coffee instead of Keurig pods (even at BJ on sale) add another $40/mo back to the budget. I haven't talked about our savings on groceries or clothing or how get tide pods for under $1/pack (16 loads = 1 month) and no more six packs of beer on the way home from work where "now and then" became a habit at $7 or so per day. No, I didn't get to that $1250+ but I didn't want to show how much money we were literally throwing away month after month. I think, for now, we'll keep Prime so Alexa can play "that peaceful easy feeling" by the Eagles just a few more times. :)

Tasia

Friday 11th of January 2019

Ray I almost just spit out my coffee reading your post about prime being cheaper than a divorce! I love your humor through here. The truth is cutting out all those little things adds up to a life-changing financial path right? Oh, I see you have another comment! Let me read that one :)

Melissa Dunn

Thursday 3rd of January 2019

I do all these 🤔 I now get Amazon Prime as part of my cell phone account..

Alana

Wednesday 2nd of January 2019

Great tips

Shelly

Wednesday 2nd of January 2019

We do go out to eat, once or twice a week sometimes and it is expensive. That alone, even cut down could save alot.