In my 38 years of life so far, there is one decision I have NEVER thought twice about in my life. Through all the ups and downs of life, you question everything. Motherhood, for one, brings about so many questions and doubts.

Whether it’s a marriage or a friendship, these relationships will have doubts stirring about in different seasons of life. In every relationship in your life, there are moments of doubt, and you wonder, should I have done something differently? Should I have taken a different path?

But the one thing I’ve never doubted or questioned was paying off all our debt and living a debt-free life and living a life where we are living below our means.

For us, that means, back in 2020, when one of my blogs had a crazy amount of growth through affiliate marketing and made the most income still to this day, we didn’t LIVE on it like we were making that amount forever.

If you have an unstable income, you know you can’t live on your best week’s income because the following week could be a lot less.

Now that I have been blogging for seven years, I have a baseline amount for income, but we continue to live below the highest earning income.

That with no debt is key to riding these ups and downs of the other stresses in life.

I can’t imagine how stressful it is for others when you have all your relationships and the issues that arise, and then if you toss in money problems, it must feel defeating.

So if you are young or just starting and want to have one thing you will NOT regret or doubt in your life- pay off your debts. Live below your means, meaning live on a little less than you make.

Once all your debts are paid off, and you start to make more money, your means will increase, but you will have the strength, wisdom, and the right mindset not to start living beyond what you can afford.

One example I shared on TikTok the other day that I couldn’t stop thinking about was how little spending habits add up.

For me, right now, it’s with the school lunches. Getting free lunches during COVID-19 was excellent, but of course, my kids now think the school lunches are gross, and that’s fine because it’s not cheap.

My youngest daughter tests my patience with what she eats from her lunch. I told her the other day to buy the school lunch because I was fed up and would rather NOT see food come home and be wasted.

At the moment, $2.50 sounds worth my sanity, and I told myself she’d eat the school lunch because it was something she liked.

But then I started adding it up. Suppose she gets lunch daily, Monday through Friday, at $2.50 each. That’s $12.50 a week. Okay, it doesn’t sound terrible, but if I consider it monthly, it’s $50 for one child.

Suppose you have four kids at $2.50 a lunch; that’s $50 a week. We know we can make lunch for cheaper, and this spending may be well worth it for some. But if you live paycheck to paycheck, this is one area where you could cut back expenses.

(I’ve done everything from getting little cutouts to these new containers- which are working better now. Grab them on Amazon here.)

How often do we only see the amount we spend in that ONE DAY?

I only saw $2.50 for lunch, and it sounded okay when I think about how much one sub is at a restaurant.

Then I think about the quality of the school lunches, and they really aren’t that great, and the amount of food they get is probably less than what I would pack in the lunch.

We don’t let ourselves see any of the downsides of our spending decisions because we want to be satisfied, and $2.50 doesn’t sound terrible. We live for instant gratification and laziness.

When we go through life and spend in that frame of mind, we end up six months down the road, wondering how our credit card bill got so out of control and depressed because we don’t make enough money.

Thinking twice about every dollar you spend can seem a little much, and I know some of my friends are annoyed with me when they go shopping because of how hard it is for me to spend money impulsively, but I never regret it.

Have I regretted spending money on certain things? Of course.

But learning how to strengthen that spending muscle has been one of my best decisions.

If you are questioning everything in life right now, start with a plan to live a debt-free life.

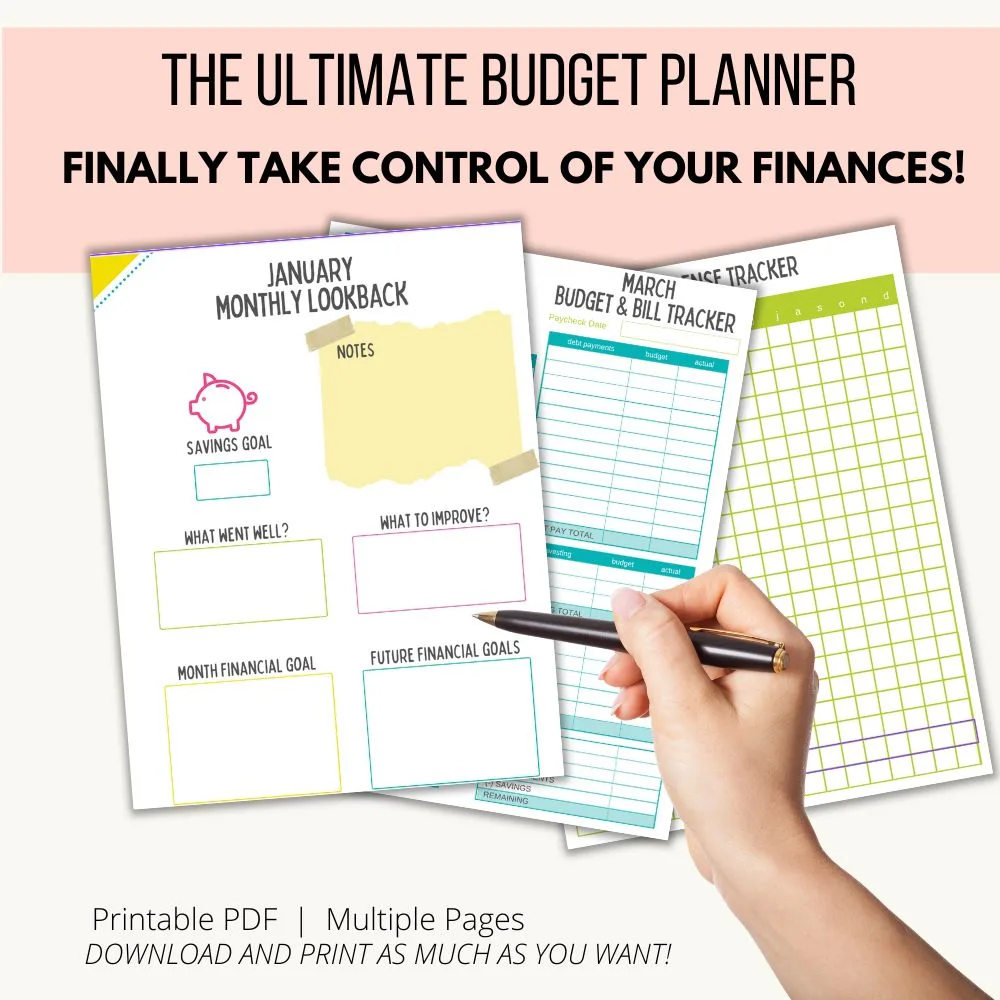

The first step for that is a budget. If you haven’t made a budget or don’t have something written down, you need to grab my budgeting binder here. You can download it, and it’s the easiest way to get started.

Check out how to start a budget on the blog here.

This decision will change your future, your kid’s future, your spouse, your friends, and every relationship you have until you die.

So what’s holding you back?

Here are five things you can do right now to get started.

Declare Your “Debt-Free” Day

Just like I decided to quit using a Target and Kohl’s charge card (and trust me, that was a tough one), you need to make a solid commitment to start your journey toward debt-free.

Choose today as your “Debt-Free” Day and mark it on your calendar. This is the day you start making changes – no more “I’ll start tomorrow” excuses!

Know Your Enemy

I mean, who goes into a battle without knowing their opponent, right? It’s time to face those scary numbers.

Gather all your debts – credit card bills, student loans, car loans, everything – and list them out. Knowing exactly what you owe is the first step towards conquering it. Write this in the budget binder.

Budget, Budget, Budget

Have you ever tried to bake a cake without a recipe? Yeah, it most likely wouldn’t work.

Your budget is your roadmap to financial freedom. Identify your income, necessary expenses, and how much you can realistically put towards paying off your debts each month.

Download an easy budget planner here.

Snowball or Avalanche?

No, I’m not talking about holiday games. These are two popular methods to tackle debt.

The Snowball Method focuses on paying off the smallest debts first to gain momentum (like my small victory over store credit cards), while the Avalanche Method targets the highest-interest debts first to minimize total interest.

Choose the strategy that suits you best.

Reach Out for Help

Discussing this with your spouse if you share finances and hold each other accountable is important. Find someone who lives a debt-free life or is pursuing one to hold each other accountable if you aren’t married or in a relationship.

Seek professional help if you’re overwhelmed.

Credit counseling services and financial advisors can provide valuable guidance and resources. There are plenty of free resources for this available online.

Remember, the decision to live debt-free is like deciding to climb a mountain. It may be challenging, but oh boy, the view from the top is worth it!