Many of us stop listening when we talk with friends, coworkers, or family and hear the word budget. We all feel like we know about it, but we don’t know how to do one.

If you manage your money correctly, a budget won’t shut you down; it will give you financial freedom. Restricting your spending doesn’t mean the world is over. It means you are giving every dollar a home.

Setting up a household budget can be challenging. Finding out where all your money is going each month and then figuring out how to make it last can seem impossible.

I’m here to help you create an adequate household budget that will allow you and your family to live comfortably without giving up any of the luxuries in life or getting into debt.

In this blog post, we’ll talk about what goes into a monthly budget, how much should go toward necessities vs. wants and needs, how often one should review their finances for improvement opportunities, and why it’s crucial for adults and children as well. Let’s get started!

Below you will find a complete guide on why you should create a household budget and how to make it. Plus, I have a household budget in Google sheets you can copy and use. The budget will be more manageable for you to complete once you’ve read the tips below.

There are many benefits of budgeting, and the best one is to understand your spending habits to save and live the life you want later on. When you know what you are doing regarding budgeting, you’ll see how easy it is to create one monthly.

Many people make the mistake of giving up before they’ve gotten started.

*Remember this is a guide for YOU to learn how to start a budget- if you are interested in my personal debt-free story, you can read that HERE.

There are FREE worksheets throughout the post to help you stay organized.

Why Make a Budget?

Budgeting can be a difficult thing to get excited about. Some people may need extra reasons before budgeting in their own lives, which is okay. However, I’m here with some personal insights on why you should do so anyway!

You might ask yourself, “Why would I want to spend time planning my spending?” If your answer is anything but yes, then it’s understandable; no one wants to plan out every penny of money coming into or going from our wallet (or even have the thought cross their mind).

But there are benefits to doing this hard work: after all those hours spent analyzing where we’re at financially, we’ll realize what needs more attention when it comes down to managing our income—extra hustling if necessary.

When my husband and I started a budget, I was unhappy about it. I didn’t like to be told how to spend my hard-earned money.

I discovered that my husband was frequenting Tim Hortons and that $20 a week seemed like a lot per month.

Go in with an honest, open attitude, and you may be surprised at how helpful this budgeting thing is. Before creating a budget, you need to focus on your why.

When you see the stack of bills sitting in the mailbox, do you get a pit in your stomach? Are you constantly wondering how you’ll make it to the next paycheck?

Peace of mind is one of the tremendous benefits associated with budgeting. Without worrying about where your next dollar will come from, you can finally relax and breathe easier, knowing that living within one’s means has guaranteed financial security for life.

Having money in savings can protect you from being forced into a terrible situation.

For example, if someone in your family is laid off and it becomes challenging to make ends meet each month, having peace of mind knowing that some excess cash saved up could be the difference between losing everything or making do with what little income they have left.

Making a budget is crucial because it helps you prepare ahead of time for inevitable expenses. Instead of just spending without thinking, having a budget gives you an idea about what you should use your money on and when the correct times are to spend or save.

Like most people, you just spend money if you have it instead of thoughtfully considering each purchase. Budgeting helps you understand the difference between the things you need and what you want.

Unless you have unlimited funds (and that’s probably not the case since reading this), creating and living by a budget makes sense. If you’re in much debt, it makes sense to stick to a budget and get out of it.

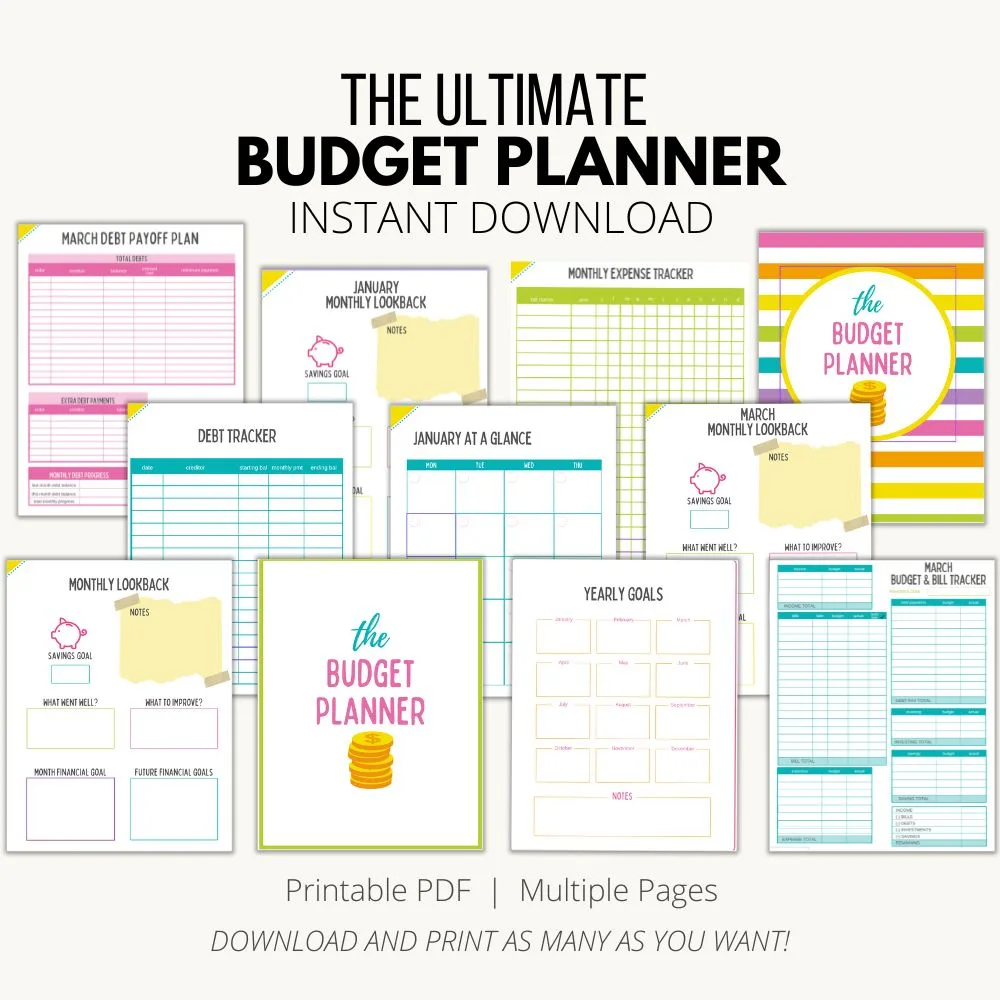

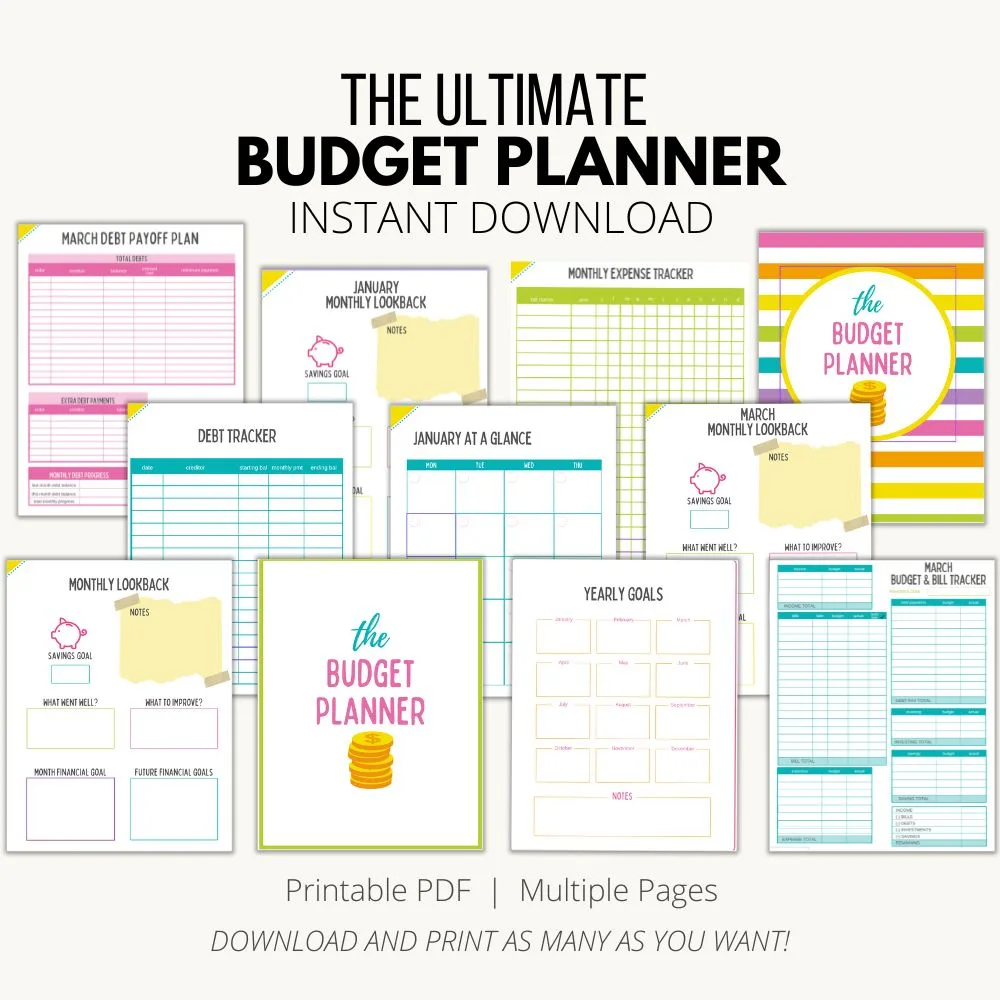

Grab a my budgeting planner below.

The Debt Danger

Being in debt can be one of the most challenging and stressful situations. It’s a situation that could have you feeling like an enslaved person, which is not what anyone wants when they’re trying their best to care for themselves or those who depend upon them but don’t know-how.

The best way to get out of debt is by making changes that will help you better control your life and avoid future emergencies.

These might include reducing spending, getting a second job, or finding more efficient ways for paying off debts with lower interest rates so that when things do go wrong, they don’t elbow their way upfront into priority status!

It’s easy to get into debt, even if you’re making great money. The more we make in a month, the less time it takes for us to spend our hard-earned cash on things like clothes or dinner with friends.

But borrowing that amount of money is something most people are not prepared for, and there can be severe consequences when your income level does not match up with what you owe every month – especially because many high earners have too much tied up in their business ventures so they cannot simply stop working without costly repercussions.

What’s Yours Is Yours – But It Belongs to Someone Else!

Many people fall into the money misconception that the items in their homes and names are theirs. The reality?

You’re paying off each month on something they own or have rights to; it might be yours, but somebody else now owns them (sometimes even mortgagees).

Imagine making a six-figure salary and charging lavish items on credit cards. While you might be able to keep up with the payments as long as you have a job, what happens if you lose it? You might be thinking that it won’t happen to you, but it can happen to anyone.

I lost my job while on maternity leave with our first daughter. It was a wake-up call that pushed us into our debt payoff journey.

Before you know it, you cannot pay credit cards, car notes, or even your mortgage. It might not have seemed unreasonable to get into debt when your income was good, but it can be financially tragic when you lose your income.

When you don’t buy items you can’t afford, you’re protected from the danger of losing everything to debt. There’s strength and confidence in being able to pay cash for your purchases.

Ultimately, that will be your goal in creating a household budget.

Common Budgeting Traps

You might think you’ve tried budgeting before and not had success. However, if it hadn’t been the right way for you, your previous attempts would have failed.

Some of the common mistakes people make when trying to set up a new budget are:

· Not making a budget that’s realistic for your family

· Making a budget but not committing to it

· Not communicating with your spouse and children about the budget

· Disagreeing on what expenses are necessary

· Misidentifying needs versus wants

· Being inconsistent with financial habits

While budgeting can be challenging, it’s not impossible. When you have a budget, you need to be realistic about your own family and communicate. In this guide, you’ll learn how to do that – it doesn’t always come naturally to people.

You’ll also need to be committed to following through with your budget. But, again, setting goals can help you motivate and see your success.

Don’t worry – we’ll cover all of that here as you continue reading.

Money Is Emotional

The topic of money is one that many people find very tedious and dry. However, the truth is that talking about it can also have a lot of emotional baggage attached to it.

You may feel happy because you’re on your way towards getting out from under debt or taking care of loved ones who need expensive medical treatments, for example.

Still, there are feelings like sadness when we lose our jobs due to declining economic conditions in our country or even fear if irresponsible spending got us into this mess in the first place!

It’s essential to separate your value as a human being from your financial worth. Everyone makes mistakes and has complex challenges.

If yours happen to be economical, you can sometimes feel desperate, humiliated, and embarrassed.

You’ll need to try to let go of those feelings so that you can look at things more objectively. It will feel excellent to get in control of your funds.

And if you’ve made financial mistakes or are experiencing hard times, you should feel proud that you’re ready to face things.

For more tips on how to stop emotional spending, read this. ( I’m a BIG emotional spender myself)

Getting on the Same Page with Your Spouse

Finances can be challenging for couples to discuss and manage. If you’re in a relationship where you share the same household or if you’re planning to shortly, you need to learn to communicate about money.

Money issues can be a significant challenge for any couple. Set some guidelines about being open when discussing money.

You’ll also need to make sure not to make things personal. For example, you may have very different ideas about spending money – in fact, you probably do.

Try not to make personal attacks when you disagree about money. If you find that you’re getting into a heated discussion, it might be best to take a break and cool off before continuing.

Working through financial issues is challenging but necessary if you’re going to have good financial health.

You may want to look for some resources to help you communicate about money as a couple. A financial counselor can be beneficial if you need an objective ear.

You may also want to look at books designed to help couples get on the same page about money.

Step 1: Know Where You Are

Before you even think about creating a new budget, you need to determine how you spend your money now. So, the first step is to keep track of what you’re spending. This is going to take cooperation between all the family members.

For at least one month, you need to write down every penny you spend. You also need to keep track of how much money is coming in. To do this, you’ll need to be as specific as possible to get an accurate idea of your finances.

For example, it’s not enough to write down that you spent $53.45 at the grocery store. You need to hang on to that receipt to know what you bought at the store. This will be important later when you’re looking at where you can trim your expenses.

We kept ALL our receipts when we started our budget. I didn’t want to mess around with apps or pay for anything extra. Depending on your personality, this may not be your favorite option.

If you want an app to track your spending, you will need to pay for it monthly. Two of my favorite budgeting apps that I’ve played around with in the past and love are EveryDollar ( Dave Ramsey) and YNAB. The EveryDollar app does have a free version.

The cheapest way to keep track is to get a spiral notebook and a large envelope. Next month, you’ll write down any money that comes in on the first two pages. Income doesn’t take two whole pages for most people, but you might want to leave some extra space.

In most households, paychecks come at regular intervals, and at most, you get paid once a week. However, there are professions where the money comes in sporadically and even daily. So make sure you leave room for all the income you receive.

On the following pages, you’ll write down any money you spend. This includes purchases made on credit cards and debit cards, and cash. So if you spend one penny, it needs to be written down in a notebook.

I use apps that give me cashback for the receipts and items I purchase- like Ibotta, Receipt Hog, and Fetch Rewards, so keeping my receipts has become second nature. First, I’ll scan the receipts and then staple them together to file for our monthly budget.

You might want to keep a smaller notebook in your purse or car to help you keep track of spending when you’re on the go. Then come home and record it in the central spiral that the entire family uses.

For every purchase you make, you need to ask for a receipt. Then, place all of the receipts in the envelope to reference later. This might be difficult to remember, but it’s the most critical step.

By the end of the month, this will come more naturally. And you’ll need to continue this habit for a while so that you can get control over what you’re spending and be aware. Awareness is the first step.

Believe it or not, most people have no idea how much money they have coming in and how much is going out. You can’t have a realistic budget if you don’t know what’s happening with your money.

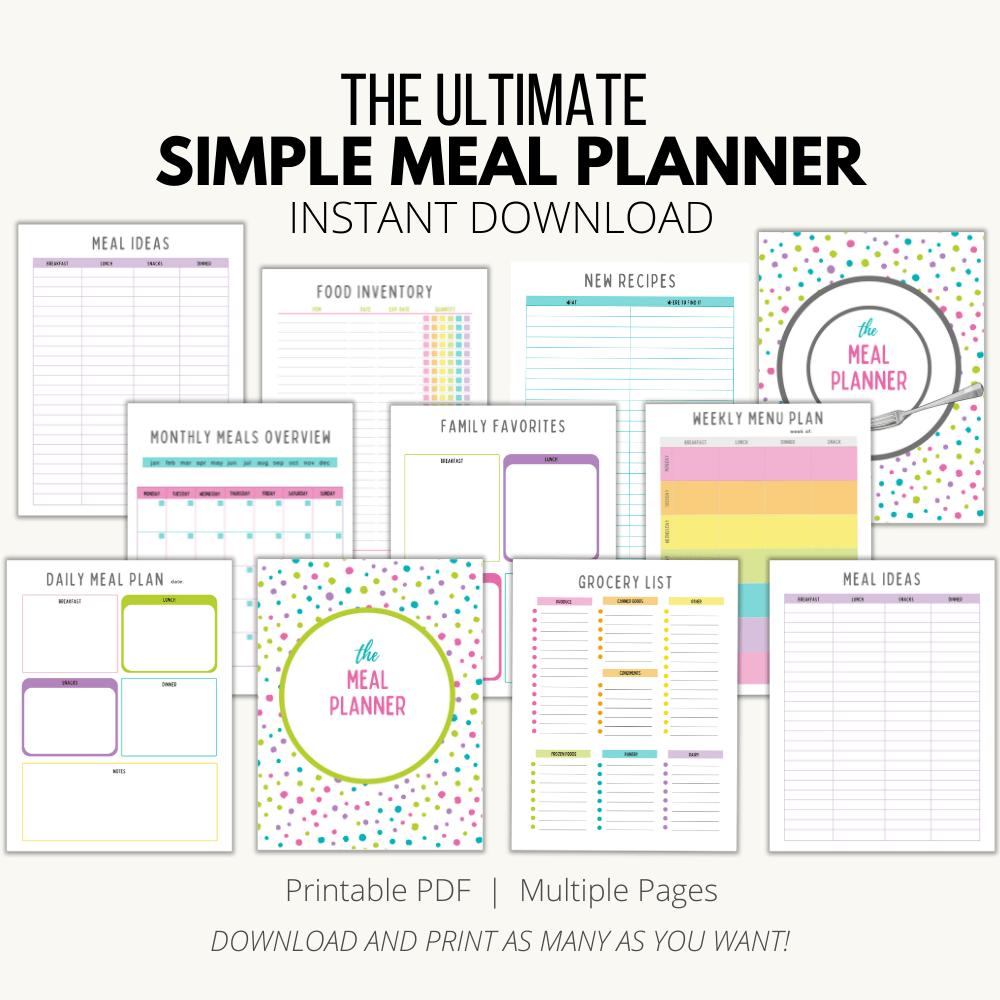

Grab my Ultimate Meal Planner below.

Step 2: A Critical Look at Your Finances

You’ve been tracking your spending for a month. Now it’s time to examine it closely. This can take a few hours, so make sure you set aside a reasonable time to do this. If you have a spouse, this process is best done together.

First, you need to go through your income and total up what you brought in. This is a number that you need to pay close attention to. You’ll want to make sure that you stay within this number with your expenditures.

Next, you need to begin categorizing the money that’s going out. Again, there are several categories that expenses generally fall into.

For example:

· Housing

· Savings

· Utilities

· Insurance

· Donations

· Debt Payments

· Transportation

· Clothing

· Expenses for school

· Expenses for work

· Medical expenses (prescriptions, co-payments, etc.)

· Food – groceries

· Food – eating out (this includes those trips to the coffee shop)

· Entertainment

· Other – depending on your family, there could be some extra categories

Getting your spending divided into categories will help you decide about necessary expenses versus those you can cut out.

Now that you have the big picture, it’s time to make tough decisions.

Grab my Budget Planner below.

Step 3: Trim the Fat or Increase Income

Your expenses may outweigh your income; this is especially true if you have any debt payments. As a result, you’ll need to trim costs or bring in more money. Which you choose will depend a lot upon your expenses.

Now it’s time to make the hard choices. You’ll need to get out those receipts now. Go through every item you’ve purchased and decide what purchases you required and what purchases were luxury items.

It can be challenging to be honest about your expenses, but it’s time to take a hard look at them and make sure you’re realistic about needs versus wants.

Take a look at some examples of things you could probably trim:

· Fast Food

· Eating out

· Salon services – hair, manicures, pedicures, etc.

· Expensive café drinks

· Magazines

· Entertainment- movies, shows, etc.

· Clothing purchases

· Travel

This doesn’t mean you have to throw out the baby with the bathwater. You don’t have to eliminate every single luxury item. However, if you’re spending more money than you make or charging items on credit cards, you need to trim those expenses.

For example, if you eat several times a week, try eliminating one of those trips. Or limit yourself to eating out once a week. If you get your nails done every week, try alternating weeks.

If you try to eliminate all the luxuries from your life, you may end up going on a spending binge later. So instead, try to be realistic about what you can live with if you have some wiggle room in your budget.

You need to think about a few things when trying to reconcile your income versus expenses. Here’s how to know if you need to make changes or if you’re doing okay. Most people have an area where they can improve.

Are you on Tiktok? Follow me over there for more tips to save and have fun!

If You Have to Charge It, You Can’t Afford It.

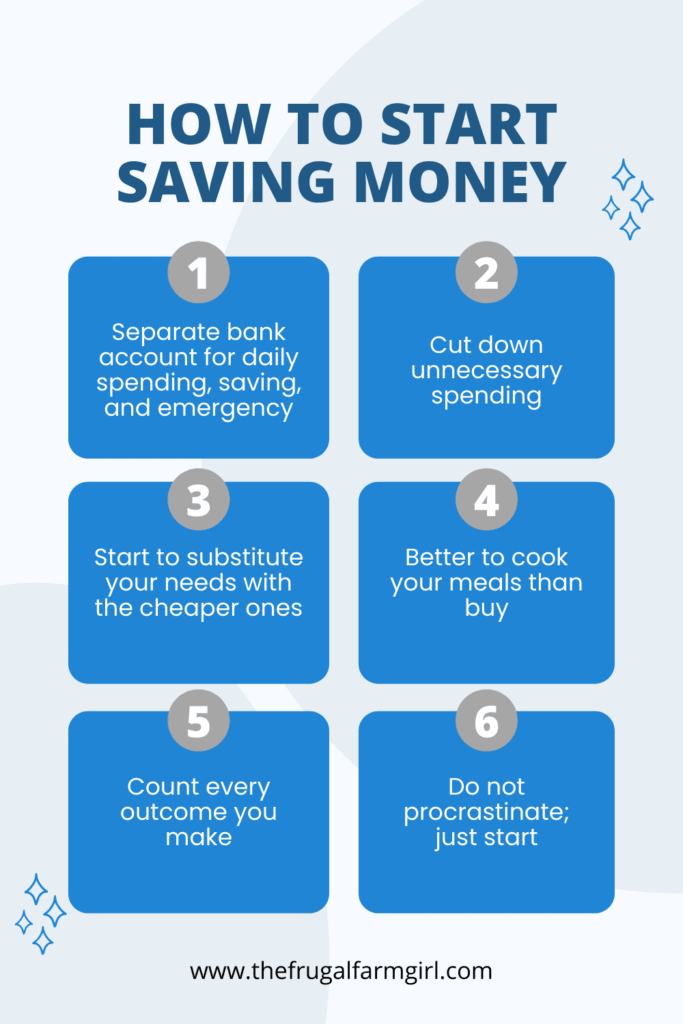

The first step to cutting back on expenses is knowing what you’re spending.

Then, if it’s not an emergency, try avoiding using your credit card for the purchase as much as possible and instead save up enough money so that when temptation arises in a store or restaurant, you don’t have to be stuck with regret later down the line because all those little purchases add up quickly!

Your goals should always start at home: stop charging on credit cards if you can’t afford something! But, of course, you won’t eliminate this expense overnight.

Still, cutbacks need to happen over time – they’ll happen gradually by learning where there are more expensive places like restaurants and stores- spend less than necessary during these times (even though temptations arise).

Credit cards are more of a trap than ever before. You see something you want but don’t have the money in your bank account to buy it right away and can’t wait for payday later this week.

So now you just reach for your credit card with some room on it so that you might get instant gratification by buying what’s making you crazy!

It feels great – until the bill arrives in the mail or your inbox. And while it seemed like a good idea at the time, credit card debt is one of the worst things that can happen to your finances.

Unless you pay off your balance each month, you’re paying a lot more than retail for the items you charge.

Credit card debt is easy to justify, but it’s better not to. Remember that if you can’t afford an item with cash or what’s in your bank account, you really cannot buy anything!

So resist the temptation of charging purchases on credit cards because once they’re charged and go into play as debt, there will be no way for them to get paid off without paying interest rates that are higher than just saving up more money from other sources like working overtime time during work hours.

Instead of increasing your debt, you need to be working on getting beyond paying the minimum payments on your credit cards. Paying only the minimums can keep you in debt forever – and the interest will often be more than the original purchase.

For tips on how to help STOP emotional spending, read this article here.

Ability to Save

Even if your expenses don’t outweigh your income, you need to look at how much you can put into savings. You should be saving at least ten percent of your income, and if you can’t do that, it’s time to cut expenses. Here is a list of things you can cut out from your budget.

If you’re already saving that amount, you might want to increase the percentage. The more money you have to save and invest, the more secure you’ll feel now and in the future.

As you’re looking at where to trim expenses, focus on putting more in savings.

Remember to use a saving account you can’t easily access. This way, you won’t be tempted to pull from it.

Have you heard of Acorns? This may be an option you choose when it comes to automatic savings. Acorns will round up your change and put that money into a savings account.

The drawback- it does cost $3 a month to use, but depending on how much you want to save without thinking about it, this cost could be worth it.

For more tips to help your savings game check out this article: 7 Tips to Improve Your Savings Game

Still Stretched Too Thin

When your budget is tight, and you want to make ends meet, cutting the extras may not be enough.

But if there’s been a significant life change, such as divorce or unemployment in recent months, it can be challenging to feel like anything will work out well – even though that’s what someone going through this rough patch needs most of all!

It seems easy: cut back on things like restaurant meals or vacations for now so you don’t go into debt from living too lavishly before your circumstances improve.

The problem? You’re feeling desperate at this point, understandably so when an unplanned event has thrown everything off balance.

If this happens, we may have to take on a second job to increase our income. I recommend looking at ways to bring in money working from home.

You can check out a list of five basic ideas to get started here. You may also want to consider getting extra education and training to help you grow your future revenue.

If you are a new parent, check out these FREEBIES to claim online!

Here are a few other ways you might be able to make your dollars stretch further or bring in more income:

· Get a roommate or rent out a room in your home

· Take a second job

· Look for financial aid for training

· Talk with family members about temporary help

· Save on groceries by using coupons and shopping sales

· Take advantage of yard sales and thrift stores for needed items

· Sell items you own that may have value

· Downsize your living situation

· Think about your talents and skills and decide if you can charge for them – for example, sewing and mending clothes, art, photography, handyman services, computer repair, yard work, and cleaning

It’s important to remember that it won’t last forever while the economy is terrible. Making sacrifices now will allow you to have a more remarkable ability to manage your finances when things start to improve.

Step 4: Realize What You Should be Spending

You may not know what you should be spending on items when it comes down to it. It’s hard to make a realistic budget if you don’t have a good knowledge of how your money ought to be distributed ideally.

Here’s a breakdown of where your money should go:

Savings 10%

Housing 30%

Transportation 15%

Food 15%

Debt Payments 10%

Other 20%

These are maximums. So if you spend less than 30% on housing, you can take that money and put it toward debt payments or increase your savings. Look at the percentages of where you spend your money. Do they match up? If not, it’s time to reallocate your funds.

If you enjoy using apps, two of my favorites are YNAB and EveryDollar. However, every dollar does have a free version you can use.

Make a plan using your income and expenses to match up a little more closely to this distribution. Then make a chart of how much should be spent each month in each category. You should post this prominently in your home.

This will be your new household budget. You’ll also want to post how much debt you have and make a plan to pay it off as soon as possible. In the next section, you’ll read ideas about how you can do that.

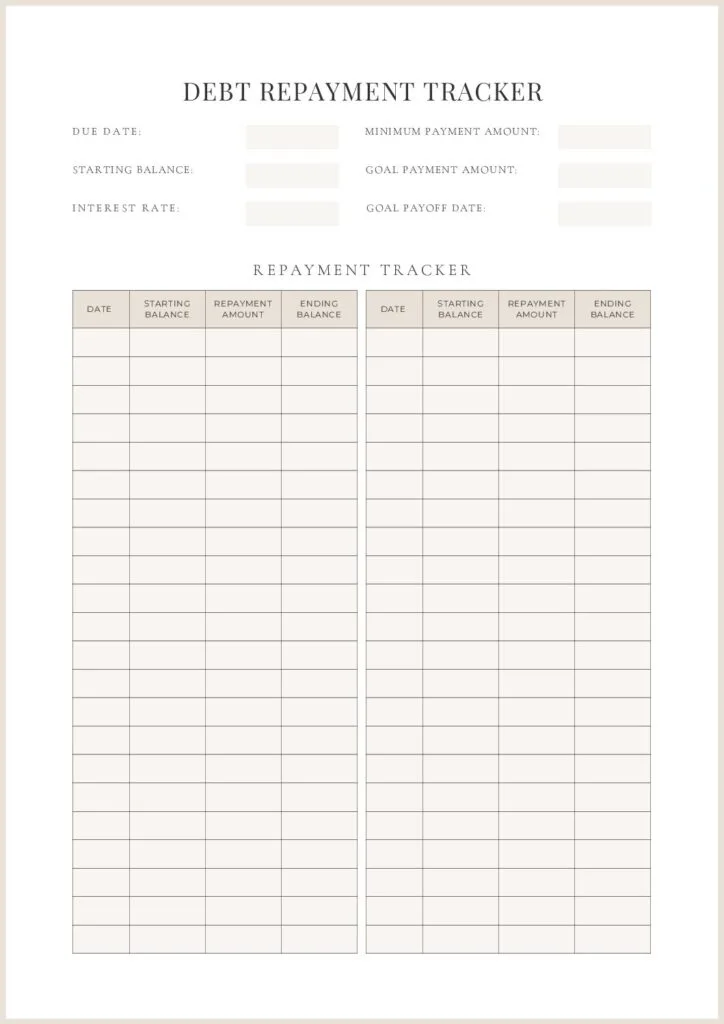

Step 5: Make a Plan to Pay Your Debt

If you don’t have debt, you can skip this section. However, most readers will find that this is an essential part of the plan.

If you have credit card debt, student loans, car payments, or any other type of loan, it’s time to chip away at the debt and become free.

Get out all of your credit card bills and look at your payments. Put them in order of smallest total balance to most significant balance. Then look at the minimum payments for each.

Rather than paying more than the minimum on each card, focus on paying them off one at a time.

Start with the one that has the smallest balance. Then, only pay the minimum payment (and stop using them!).

Then, for the card with the smallest balance, take any extra income and put it toward that card until it’s paid off.

Once you pay off one, move on to the next lowest balance. When you pay off that one, go on to the next one.

Continue doing this until you pay all credit card debt off. It may seem like a never-ending and challenging process, but you’ll feel extra motivation once you pay off that first card.

Step 6: Continue to Track Spending

You know what you have coming in, going out, and you have a plan to pay off debt. Now you need to continue to track your spending. This will help you to stay accountable for sticking with your plan.

Many people make a budget but then stop paying attention to spending and earnings. To succeed, you’ll need to continue writing down every penny so you don’t get out of control with your spending.

Writing down your purchases will help you to be more mindful of them.

In addition, it will give you a moment to consider whether a purchase is essential or if it’s within your budget plan.

Step 7: Plan for Your Tomorrow

Saving for a future that you don’t know is far-off can be daunting. However, when your debt finally ends, and the freedom it brings begins to settle in, it becomes easier to start thinking about what’s next: career goals, family time with new arrivals, or planned vacations.

But before we plan too much further ahead than paying off our mortgage (which may not happen this year), there are some steps we need to take right now so that those plans never have any obstacles holding them back from getting started!

Cutting back on expenses is a great way to save money and get out of debt faster. The best thing you can do when your finances are tight (or even if they aren’t) is cut spending every day until there’s more cash coming in each month than going out – this will help put some serious distance between yourself and those old debts!

Some of the things I look to cut back on is streaming services- do we need to be subscribed to five different ones? Can we do Hulu with Commercials? Can you cut back on how many times you eat out?!

If you need tips on cutting back expenses, check out the article here.

At this point, you’ll want to increase the amount of money you’re putting in savings and begin to think about investing in your retirement and education funds for your children. For this step, you’ll want to contact a financial planner.

A financial planner can help you determine what investments are suitable for you and your family. Don’t just go with the first person you meet.

Meet with a few financial planners to compare what they offer for you. Then, with the information in hand, you can choose one that seems the best for you.

A book I highly recommend for saving for your future is “The Smart Woman’s Guide to Planning For Retirement- Mary Hunt.”

Including Kids in Your Budget Planning

Money is a significant part of life. The earlier your children learn about it, the better off they’ll be in their adult years.

To do this, you need to include them as much as possible and make sure that these habits set by now are ones they can carry throughout adulthood.

You may want to sit down with everything on your own and even make a poster of how much is coming in and going out before sharing the process with your kids.

But once you understand the big picture, you can talk to them about what you need to do.

Let your kids help you eliminate unnecessary expenditures – no doubt some of those purchases are for them.

However, when it comes to buying toys and extra things that they want, it’s good to start an allowance to begin understanding how to earn money and budget for themselves.

A good rule of thumb is for allowance to be one dollar for every year of a child’s life. You can distribute it weekly or every two weeks. Your child needs to learn about money through chores.

They don’t have to be significant chores, and they should be age-appropriate. Then help them to set up a container for savings and spending.

You may even want to have a jar for donations to teach children about sharing what they have early.

As children, they can save more than you probably can as an adult. So you might want to start by saving 20% of their income. Then, make sure to help them figure out how much and place it into the containers.

Then when they want to purchase something, you can help them figure out how long it will take to earn money. Then, when they have a decent amount of cash in their savings jar, you can take them to open up a bank account so that they can become familiar with the banking system.

Of course, there is an app for this too! Greenlight is all about financial education for kids. They help them learn about money management through a safe, secure app where parents manage every dollar and see every transaction.

When you sign up through my link here, you will get a 30-day FREE trial. You do need $10 to put into the account to start. This is an excellent way for older kids to have a little more responsibility while you can monitor spending.

Discussing finances openly with your children will also help them understand why they can’t always have what they want.

For example, instead of saying, “We’re too poor for that,” you can explain that the purchase isn’t in the family budget.

They are bringing the family budget out where everyone can see it can help kids be part of the financial team.

For example, if you want to take a family vacation, it can be written on the poster, and the kids can be taught that they have to give up some wants to save for something even better.

Many people try to keep financial information away from their children for fear that they will then worry. But children need to learn about finances early so that when they become adults, it’s not a shock to manage their own money.

You’ll be setting your child up for future financial success. Many people make financial mistakes because they aren’t educated about money or have spending habits that began as a child.

In addition, people have emotions surrounding money that begins in their childhood and continue into adulthood. Therefore, educating your children now is an excellent gift for them.