Are you ready for this to be the moment, the year you say enough is enough? We are making a change in our financial future. Plan for the future, enjoy the now. Learn how to find the balance we all need and can achieve. Below are 11 ways you can live below your means, and eleven ways we have as a family.

“Sometimes you are not willing to give things up in order to achieve your goals!”

( Thanks, Dave Ramsey!)

Here are 11 Ways to Really Live Below Your Means

Make a Budget & Goal

Almost everyone will agree they want more money. Yet, when you ask them how much they are spending each month, the majority of us say, ” too much.”

We know we are overspending but it’s easier to ignore it and hope we spend less.

It’s time to dig in and know exactly how much money you are spending a month.

Start with your bills. The things you must pay every month. Then you break it down to other needs and then wants. There is a great sheet to get you started in budgeting here.

Start by listing all your expenses and income over the last 3 months. I kind of snuck another one into this one but it goes hand in hand in a way. When you make your budget, you will be able to make a financial goal.

What is it you are striving for? Is it to be able to pay for everything with a cash/debit card? Is it to have extra money to put into savings? Is it to pay for a family vacation? Is it to get all your bills paid? When you have a goal you know where you are heading.

When you have a budget, you know where your money is going, these are two things that are life changers. Write your goal down. Keep it in a place where you can read it daily.

Use it when you want to give up to remind yourself what you are working towards. Think about the positive impact this financial goal will have on you and your family once you reach it.

Here are practical tips to achieve financial freedom if you can just understand one concept, it needs to be this.

Recognize When You Need Something & When You Want Something

Needs and wants are two different things. The items you talk yourself into are not needs. Do you need a brand new car over a new car? Why do you need a new car? Is it because of the social order it will put you in? It’s like fancy purses. Sure everyone enjoys a new purse.

Anything new is exciting and enjoyable. But why have a fancy purse when you don’t have any cash to put into it? Don’t let stuff cover up you. You matter.

People won’t remember your stuff, they will remember you.

“Discipline yourself by recognizing is this a need or a want?”

Keep track of everything you are spending. Or maybe look back at that room full of stuff and see what you really need and what you can get rid of.

Tip: You can take it a step further and save money this week by living off what’s in your pantry. Here’s how.

Don’t Put on the Comparison Suit

Think if you lived in a place where you encountered two other people. You would start caring less about what you have compared to them. Think if you didn’t watch any T.V. or read any magazines or blogs about other people’s lives. Your comparison suit would hang in the closet.

The temptation wouldn’t be as strong. We live in a culture today that screams lust and stuff. You need more and more. And not more used stuff. The latest and greatest. Stand up for who you are.

I believe once you start this financial freedom path that excitement of showing off your brand new Lexus just may not have the same effect you thought it would. Do not compare yourself to anyone. Once you have your budget set keep your mind there!

Stop Using Your Credit Card

Oh, the considerable debate. I hear it now. “But you get so many points back.” Have you ever met someone who is making a six-figure say, ” My credit card points got me here.”

Let’s look at the facts. Credit cards make it very easy to buy things to get the points.

The points entice us to spend more. You find you’re convincing yourself to buy that outfit because you’ll get $2 back. $2 back or spending $30 on a new outfit you didn’t need? See where the line is?

If you have the discipline to buy what you need and can pay off your credit card bill each month then fine, use it. According to statistics, there is a small percent of us Americans who have the willpower to walk away from the power of purchasing it on a plastic card.

Buy things with money you have- CASH, Debit Card!

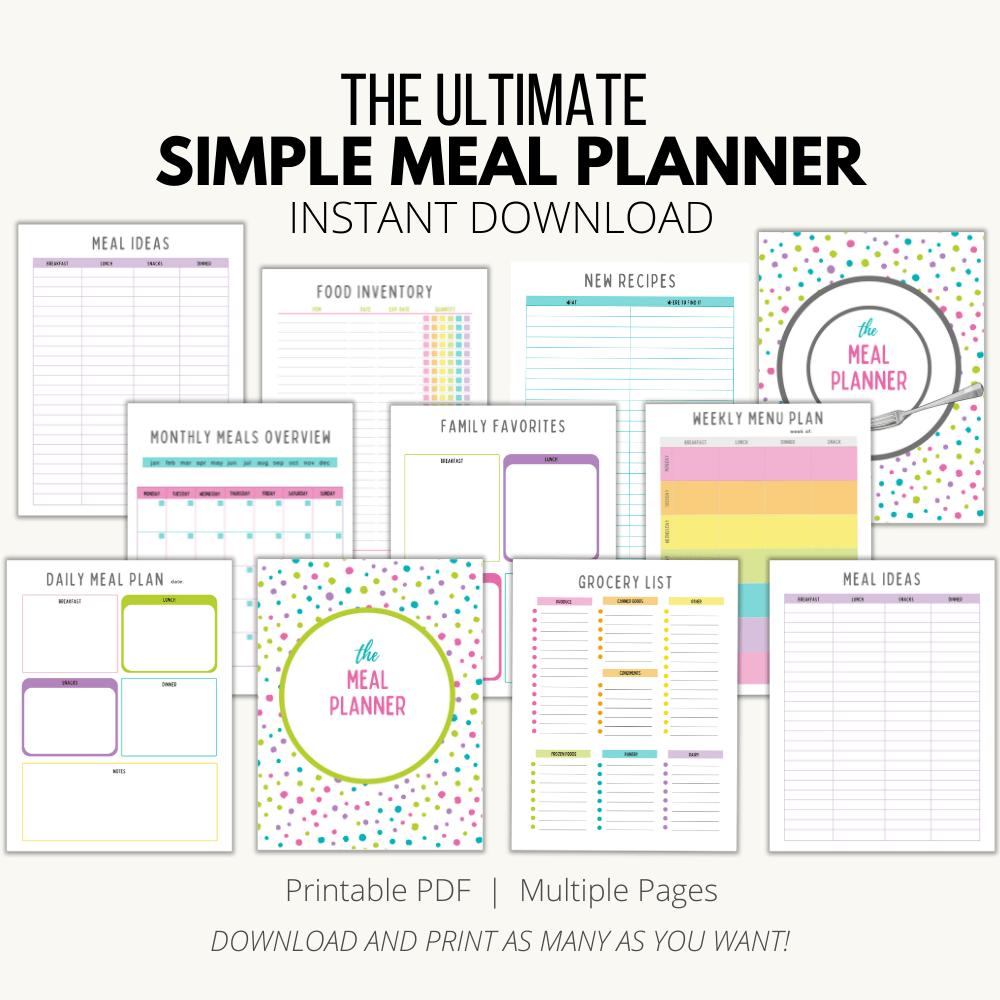

Get to Making Your Own Meals

Ok, so you don’t like the word meal planning. Make your own meals at home. This can be so huge when it comes to saving money and helping with our discipline to look at needs versus wants.

When my husband was working out of town, and I felt exhausted on the third night of being with them, I wanted to run out to eat.

Guess what? Our budget said you can’t. Sure, I could of have given in to that want. It would have come out of somewhere else. The amount of money we needed for our electric bill.

Then the money for our electric bill would be short so then our cable bill would be and the cycle continues.

Before you know it, I’m on the phone with my best friend saying we are so broke. If you need some new fun hacks for meal planning, go here.

Shop From Your Pantry

When you only have enough money to pay your bills for the week, swallow your pride.

Try to serve mac and cheese for the whole week if you have to. You all will survive and next week you can change your menu based on your finances. The point is when things are tighter one week be resourceful.

If you are new to this eating from your pantry here is how to get started.

Try to look in your cupboards for some simple meals you can make. Check Pinterest and just googling items from your pantry for recipes. You will be surprised how filling beans and rice can be.

Don’t feel any guilt for not serving your family a serving of fruit and veggies and so forth. That day will come. This week your priority is your finances. Of course, you have to feed your family but you can do it for less without taking from your expense budget.

Use what you have in your cupboards 1st when planning a menu.

Plan your menus according to what is on sale.

Follow a Coupon Site

Follow a coupon site that does matchups if you are crunched on time and to help you plan your meals. There are so many great blogs out there follow a few.

Coupon Matchup lists are taking a sale item and pairing it with a coupon or an app offer. Clipping coupons will save you a lot of money but there are now many ways to save with apps as well.

I have to emphasize shrinking your grocery bill because it’s one of the quickest areas in your budget to shrink. It’s one you can work with based on your income. When it comes to paying your rent or mortgage, those things don’t budge.

Cutting back our grocery bill by 60% allowed me to stay home with our first baby and start our debt snowball.

6 years later we are paying off our mortgage after paying off student loans, credit card, and car loans.

Invest Time

It is crazy how many things you can get for free or cheap if you invest time. I’m a coupon deal blogger and I share freebies on my blog daily. I haven’t paid for a magazine subscription in five years. I’ve got the Wall Street Journal for free for almost an entire year.

You could get enough free samples of shampoo and deodorant that you don’t need to buy a full jar. If things are tight and you are tired of living paycheck to paycheck- invest time to get things for less.

Take advantage of all the free information you have at your fingertips. If you have time, you can live on less and have so much more my friend.

Change your Social Status

During this season of life, you may need to closely examine your circle of friends. When you are trying to pay off debt and not spend money, it’s not so easy to get together at Starbucks with so and so even though you need a break from the baby. You don’t have to end any relationships.

Pss. If you are going to be on Facebook, you better make money from it here.

Just let them know you are serious about taking one step toward a greater victory. That victory is debt-free living. They may not stay and hold your hand and that is ok. You need to do this.

Be careful scrolling through social media if anything triggers you to want to spend or to get you sidetracked thinking you can’t pull this off.

You can. You will.

Have Fun

Sometimes when we start something new we want so badly to succeed we get blinders on. Don’t deprive yourself when you are living life on a budget. A budget should not be something that makes you cringe. It should make you feel in control.

Check out this article on how to increase your income instantly without getting a second job. It comes down to balance. Balance is one of those things we are always needing to adjust and it is so crucial to so many things we do in life. Part of that balance is being able to have fun while you are saving money and working towards a financial goal.

Take the things you enjoy doing and get creative and see how you can do those for less. If one month you can’t afford to go to your favorite place take these tips into consideration and remind yourself one day you will be able to. You will not be in this place forever. I know because I was there too.

I thought things were always going to be tight living week to week. I’m here to tell you it gets easier and you will be rewarded for your discipline and hard work.

Don’t Deprive yourself.

Get Support

This may sound like I just took it to a whole new level that you want nothing to do with but hear me out on this one. The definition of support is a thing that bears the weight of something or keeps it upright. You need others to help keep you upright.

Upright on the right path. If you have friends who call you up and always want to go to dinner and a movie type of thing tell them your situation and how you are working toward a goal. You do not have to go into every detail but when you let others know you will see how many support you.

When you get the support to what may feel like a painful lifestyle change at first, you will feel encouraged and find it easier to strive towards that goal when your friends and family are behind you.

Those who love you and support you will always help you get through the comparison struggles we all experience. Remember your goal.

Grocery shopping is the one thing you can cut costs on.

We have so many choices here. It does take a little bit of time, but so totally worth it. When we are not spending a lot of money on food that is overpriced and terrible for us, we will have money to go on trips with our families or whatever else it is that brings enjoyment to you.

See you won’t be deprived and it won’t be so painful! I went on a 6-month spending freeze and survived and came out stronger. You got this!

“For I know the plans I have for you,” declares the LORD, “plans to prosper you and not to harm you, plans to give you hope and a future.”

Cat

Friday 4th of September 2015

I think this is a great post. I would love to share it on my FB page. Thanks for the post.

Tasia

Friday 4th of September 2015

Thanks! Of course share away!

Bonnie Lyn Smith

Monday 23rd of February 2015

These are great reminders! Thanks so much! I love what you are doing with your blog! It's unique, and I always learn something when I stop by. We need to count our pennies, too. Loved the pantry tip!

bataviasbest

Monday 23rd of February 2015

Bonnie I am so glad you are enjoying the blog! That means so much!

Andrea

Monday 23rd of February 2015

Operating on a cash basis saved us when I quit my job - we each get a set amount per week, and when it's gone, the buying stops until the next paycheck. Anything carried over goes into savings. It really makes you think about whether or not your really need that latte or piece of junk in the checkout line.

bataviasbest

Monday 23rd of February 2015

Using cash and just not buying anything when the cash was gone was such an eye opener for us. I used to say well if we only have this much in our account I'll just use my credit card so we don't bounce. Now I am so so thankful that is not an option anymore. And we have financial freedom!

Mary Collins

Monday 23rd of February 2015

I agree with you in that we are awash with ads telling us that they can finance whatever it is they are selling. It happens slowly...the debt. Making a budget and then sticking to it is key. Life can get in the way sometimes and can cause you to get off track but it's important to get back on track as soon as possible. To be free from debt is glorious.

bataviasbest

Monday 23rd of February 2015

We can finance way to many things these days! I agree being free from debt is glorious! Thanks for stopping by Mary!

Awells

Friday 16th of January 2015

I love how you mentioned to use what's in your cupboards first when menu planning. When you go to the store without a real direction or game plan you (we/people) tend to spend more than expected. Also, I very much agree you can't compare yourself to others. We see someone else's nice house or car, what you don't see is their debt.