Frugal living is about making conscious decisions to spend less, save more, and manage your finances effectively. Living a frugal life doesn’t mean you are going to cheap out; it means you will be smart with your financial decisions and learn how to balance finances and time.

I’ve had plenty of comments where people on social media tell me I’m not frugal because I shop at a grocery store. Or I’m not frugal because I don’t hang my clothes up to dry. That is not what being frugal is about.

For those with large debts, frugal living can be a powerful tool to help regain control of personal finances and pay off debts faster. This comprehensive beginner’s guide will provide essential tips and advice on budget planning, debt management, reducing expenses, and saving money.

1. Assess Your Financial Situation

Before diving into frugal living, it’s essential to understand your current financial situation clearly. Start by listing all your income sources, debts, and monthly expenses. This will give you an overview of where your money is going and help you identify areas where you can save.

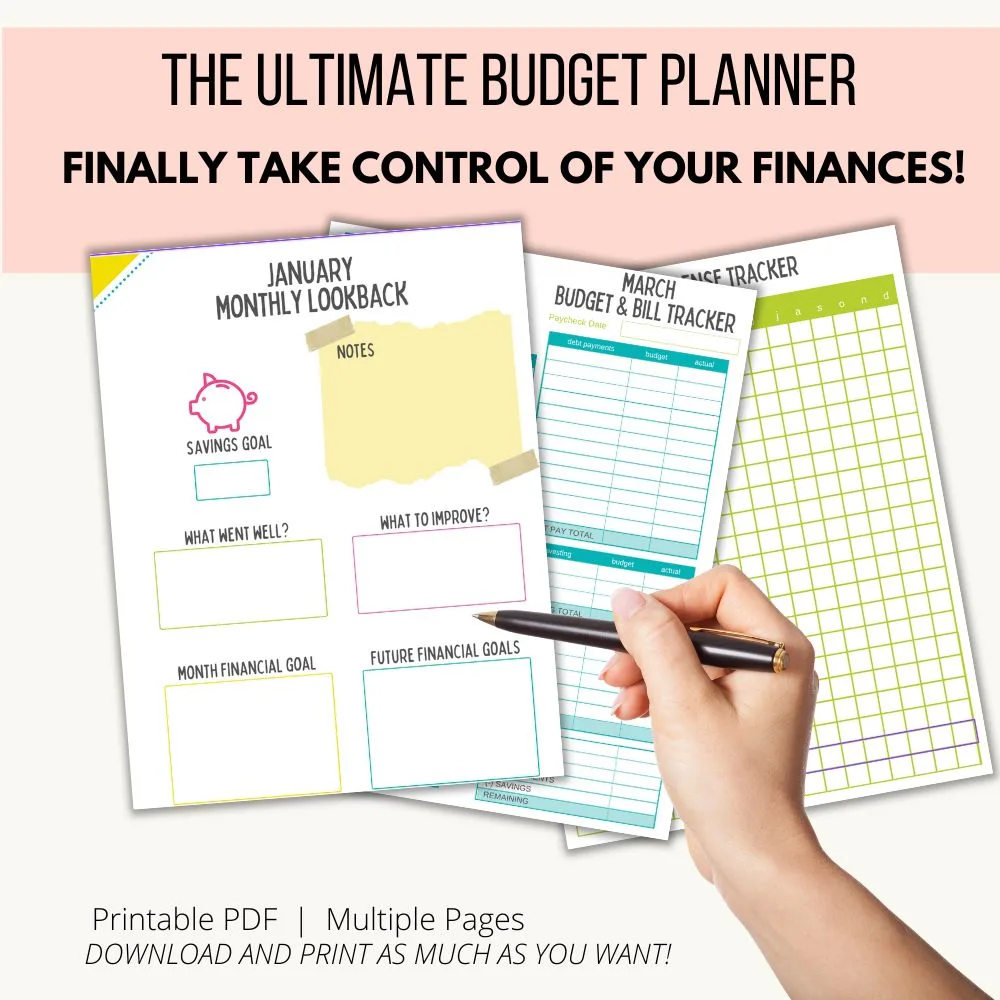

If you are someone who needs to write this down, grab my Budget Planner that you can print and start filling out asap!

2. Create a Realistic Budget

A well-planned budget is the foundation of frugal living. To create a realistic budget:

- Categorize your expenses (e.g., housing, transportation, groceries, etc.)

- Determine your monthly income

- Allocate funds to each category based on your priorities and needs

- Track your spending and adjust the budget as needed

Trim unnecessary expenses: Identify areas where you can cut back without sacrificing your basic needs. Consider reducing dining out, entertainment, subscription services, and impulse purchases.

Remember, if you start these habits now, it doesn’t mean you won’t ever go out to eat frequently again, or get tickets to shows, etc. You are choosing to eliminate wants over needs while you meet your financial goals.

Keep in mind the goal is not to eliminate all non-essential expenses but to find a balance between enjoying life and managing your finances responsibly.

3. Prioritize Debt Repayment

To effectively pay off your debts, prioritize them based on interest rates or outstanding balances. Focus on paying off high-interest debts first, as they accumulate interest faster. Once you’ve paid off one debt, move on to the next highest priority.

No matter what, during this stage, do NOT give up. Even if you have a small setback, we all make mistakes. When we started our debt-free journey, I was bitter and angry about giving up shopping trips to Target or buying new things, but now looking back, the stuff I would have accumulated would be long gone by now, and the debt would still be with me.

I haven’t once regretted the decision to live a debt-free life.

Consolidate or negotiate debts: Explore options like debt consolidation loans or balance transfers to simplify multiple payments and potentially secure lower interest rates. Negotiate with creditors for better terms, or consider working with a reputable credit counseling service.

4. Reduce Expenses

Frugal living involves finding ways to reduce expenses without sacrificing quality of life.

Here are some suggestions:

- Housing: Consider downsizing, moving to a more affordable area, or refinancing your mortgage.

- Transportation: Use public transportation, carpool, or bike instead of driving. If you must drive, maintain your vehicle to maximize fuel efficiency.

- Groceries: Plan meals, create shopping lists, and often cook at home. Buy in bulk and look for sales or discounts. Grab my Meal Planning Binder here.

- Utilities: Save on energy bills by using energy-efficient appliances, turning off lights when not in use, and reducing water waste.

- Entertainment: Explore free or low-cost alternatives such as libraries, parks, community events, and online resources for entertainment and recreation.

For a longer list of ways to cut back expenses, check out this article.

I love this cute binder to use for a frugal living lifestyle.

5. Increase Your Income

In addition to cutting expenses, consider ways to increase your income. This could be through a side hustle, freelancing, selling items you no longer need, or seeking a higher-paying job.

Many of you tell me this on Titkok; I can’t increase my income. But if there is no way for you to increase your income, either in your current job or starting a new job with higher pay, then you have to use your time. Even if it means you only have half an hour a day. Use it to research side hustles.

In today’s modern world, there are SO many ways you can make money online. Give your passions and strengths some thought, and see what side hustles you could work into your week.

When my girls were a baby and two years old, I used all my extra free time to research and learn how to start a blog. I did NOT have a social life during those years, and I was mostly okay with it. I dedicated every little nap time or late-night feeding to researching and starting my blog.

I knew that blogging could be a major financial game changer for us, and I was reading back in 2014 how bloggers were making $15k+ a month, which became something I could NOT let go of. I had to be a part of it.

Now here we are in 2023, and I don’t have to dedicate as much time to my blogging business because blogging is a great way to build multiple income streams without you working eight hours a day.

6. Build an Emergency Fund

An emergency fund is essential for unexpected expenses, such as medical emergencies or job loss. Aim to save at least three to six months’ worth of living expenses.

I can hear you now, “How do I save money when I don’t have money?” This is why you must try to increase your income- even if you increase it by $1 a day. Maybe while you are researching your side hustle, you NOT spend money for a day, then the next week, try not spending for two days.

If you are reading this now and making excuses, take a minute to let all the procrastination and excuses go, and realize right now that you are choosing to change YOUR financial future. It’s in YOUR hands, and you can do this.

Think of your incredible story, for all those hardships racing through your mind right now that you can share with someone you overcome.

I overcame these hardships, and I’m here sharing with you-you can too, and it’s worth it in more ways than you can imagine right now, and I’m sure you are imagining a ton of ways having no debt would change your life.

7. Make Saving a Habit

Develop a habit of saving money consistently. Set aside a portion of your income each month for savings or investments. Automate your savings by setting up automatic transfers to a dedicated savings account. ( Don’t let yourself think of that savings account as a place to go and grab cash) It’s off-limits.

The minute you start going back to take money- you aren’t changing your mindset, and this won’t get you any closer to your financial goal.

The problem with this is when you go and take $100 out of that savings account; it has no immediate impact on your finances at that moment. That means you’ll go back when you want extra cash, BUT it will hurt badly in the future.

Wouldn’t it be nice to go on a family vacation you paid for? No monthly payments on the credit card? Or retiring early?

If you tell yourself you’ll put extra money back in next week, you are fooling yourself. Just don’t go to that account. Let it be.

- Compare prices: Before purchasing, research prices online, compare different stores, and look for sales or discounts. Price-tracking websites and mobile apps can assist you in finding the best deals.

- Utilize coupons and rewards programs: Clip coupons, sign up for loyalty programs, and take advantage of cashback offers to save money on everyday purchases.

- Adopt a “wait-and-consider” approach: Delay impulse purchases for at least 24 hours. This habit helps you evaluate whether you truly need the item or if it’s an impulsive desire.

To learn how to extreme coupon to really save money, read this article.

Real-World Scenarios

- Scenario 1: John has $10,000 in credit card debt with a 19% interest rate. By prioritizing this high-interest debt and paying an extra $200 per month, he can save thousands of dollars in interest and pay off the debt much faster.

- Scenario 2: Sarah wants to reduce her grocery bill. She starts planning her meals, shopping with a list, and buying store brands. As a result, she cuts her monthly grocery expenses by $150.

You can check out my personal debt-free story here.

Resources and Tools

Check out some of our favorite resources and tools. I love following YNAB on Tiktok. Today check out Tiktok and Youtube for more tips and ways to keep you encouraged and on track. It’s nice to have some financial accountability show up in your feeds.

- Budgeting apps: Apps like YNAB (You Need A Budget), and EveryDollar can help you track your spending and create a personalized budget.

- Debt repayment calculators: Online calculators, such as Unbury.me and Debt Snowball Calculator, can help you determine the best strategy for paying off your debts.

- Personal finance blogs and books: Educate yourself on personal finance by reading blogs like The Simple Dollar, Mr. Money Mustache or books like “Your Money or Your Life” by Vicki Robin and Joe Dominguez.

Frugal living is not about deprivation but about making smarter choices to achieve financial freedom. By following these tips and embracing a frugal lifestyle, you can effectively manage your debts, save money, and build a secure financial future.

To get started grab this adorable and functional Frugal Living Binder!