Ah, money. It’s a tricky thing, isn’t it? We need it to live, yet it seems like there’s never enough of it to go around. And saving? That’s a whole other beast.

According to a survey by Capital One and The Decision Lab, 77% of Americans are feeling some sort of financial anxiety. Now, that’s a lot of people losing sleep over their bank accounts.

We’re all part of this exclusive club that nobody wants to be in.

So, what’s causing all this stress? Well, there are a few culprits. The first one is living for today.

We’ve all been there, right? You see something shiny and new that someone shared on social media, and before you know it, your credit card is out, and you’re justifying why you absolutely need this thing that you didn’t even know existed five minutes ago.

Then, there’s the big D – debt. It sneaks up on you. One minute you’re using your credit card for emergencies, and the next, you’re using it to pay for groceries because your bank account looks a little lean.

And let’s not forget about those poor purchasing and investing decisions. There are people out there buying stocks because they like the company’s logo. Spoiler alert: That’s not a great investment strategy.

Not having enough emergency savings and struggling to cover everyday expenses are also major concerns. It’s like trying to fill a bucket with a hole in the bottom.

No matter how hard you try, you can’t seem to get ahead. Inflation and economic instability are like unwelcome guests at the party. Just when you think you’re getting a handle on things, they show up and throw everything into chaos.

But the good news is, with all these financial obstacles, you don’t have to let them take hold of your life. You can overcome them. So today let’s take a quick look at some strategies to get you started.

- My husband and I live a debt-free life, which started when our girls were babies and toddlers; it was NOT easy, and we lived on one income. Here’s our story.

Common Financial Obstacles

We’ve all been there: the car needs repairs, the heating bill is higher than expected, or your kid decides to take up an expensive new hobby (I’m looking at you, horse riding!).

These unexpected financial obstacles can throw a wrench in even the best-laid out savings plans. But don’t despair. Let’s dive into some actionable steps to overcome these obstacles.

1. Create an Emergency Fund

This is your financial safety net. Start by setting aside a small amount from each paycheck until you have enough to cover three to six months’ living expenses.

Trust me, it’s a game-changer. It’s like having a financial superhero ready to swoop in and save the day when unexpected expenses strike.

2. Prioritize Your Spending

Take a hard look at your expenses. Are there any areas where you could cut back? Maybe that daily latte or weekly takeout could be swapped for cheaper alternatives. Remember, every little bit helps.

I love to have a reset and do a no-spend month. January is a popular time for most people because of the effects of holiday spending. This works your spending muscle and helps you to think about everything you need instead of want.

Habits are crucial when it comes to saving money, and a spending freeze is a quick and efficient way to prioritize spending. If you haven’t done one before, get started here.

3. Make a Budget (and Stick to It!)

I know, I know, budgeting can feel like a chore. But think of it as your financial roadmap. It helps you see where your money is going and how to allocate it better.

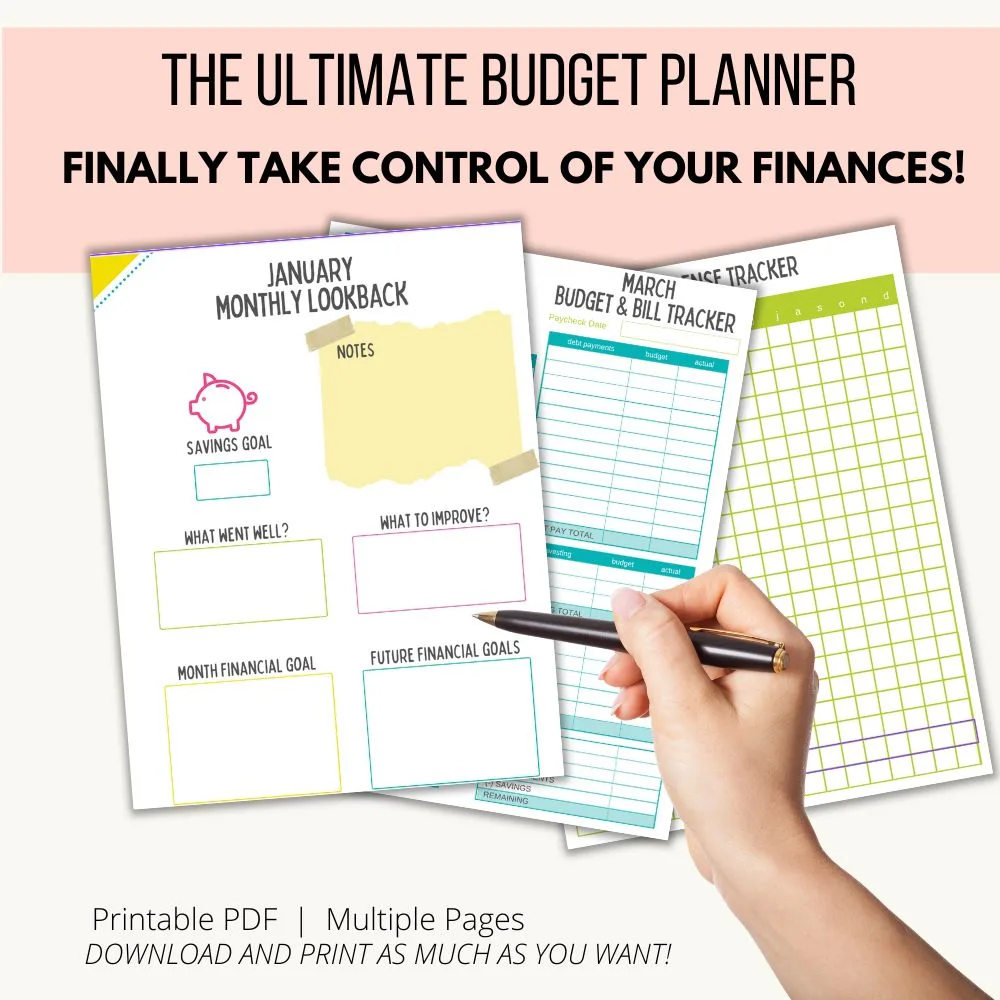

Plenty of free budgeting apps are out there to make this task easier. I use this cute budgeting binder because it’s basic and easy, and I can reuse it every month.

4. Find Extra Income

Do you have a skill or hobby that could earn you extra cash? Now’s the time to put it to work. Freelance writing, dog walking, selling homemade crafts – endless possibilities.

Check out websites like Upwork or Etsy to get started.

5. Celebrate Small Wins

Remember, every step towards your savings goal, no matter how small, is a win. So celebrate them! It’ll keep you motivated and make the whole process more enjoyable.

Share your struggles with others, and celebrate together.

In conclusion, while the road to financial freedom may be bumpy at times, with these strategies in your arsenal, you’ll be well-equipped to tackle any obstacles that come your way.

So gear up, stay positive, and let’s crush this Bi-Weekly Savings Challenge together! Remember, as the old saying goes, “A penny saved is a penny earned.” Happy saving, folks!

New to the bi-weekly savings challenge? Get started here!