Have you ever felt like your savings account leaks? I know mine did. Every time I tried to fill it, the money seemed to trickle away.

But then, I discovered the Bi-Weekly Savings Challenge, and let me tell you, it was a game-changer! And today, I’m sharing some fun-filled hacks to save more during this challenge.

Grab this free printable and other options here.

Bi-Weekly Savings Challenge: The What and Why

Before diving into the hacks, let’s quickly define the Bi-Weekly Savings Challenge. It’s a commitment to put away a specific amount of money every two weeks.

It’s simple, it’s manageable, and it’s surprisingly effective. Trust me, I’ve been there, done that, and got the savings to prove it!

You can read our blog post on the Bi-Weekly savings challenge for beginners here.

Now, onto the fun part – the hacks!

1. Embrace DIY Projects

One of my favorite ways to save money is by embracing DIY projects. They save you a ton of money and are also a great way to unleash your creativity.

Take Sarah, for instance. She managed to save a whopping $200 a month by making her own cleaning supplies. Plus, she swears her house has never been cleaner!

2. Adopt a Thrifty Lifestyle

Another great way to save money is by adopting a thrifty lifestyle. This doesn’t mean you have to live like a hermit. It just means being more mindful of your spending.

You won’t know what you cut back on until you start tracking your money. If you aren’t doing that, get started ASAP. For example, my friend Mike bought a Starbucks Grande latte three days a week at $5 a pop. He did this for an ENTIRE YEAR!

That’s $780 in lattes! Imagine if you did this daily. That’s just ONE example of thinking a smaller dollar amount doesn’t add up to much.

Find those spending leaks and see how to end them to get you back on track financially.

3. Get Creative with Leftovers

Did you know the average American household throws away 200 pounds of food yearly? Americans waste about 60 million tons of food every year. Shocking, right?

One way to save money (and reduce waste) is by getting creative with leftovers. Turn yesterday’s roast chicken into today’s chicken salad or chicken tacos. The possibilities are endless (and delicious)!

Search the terms cook once, eat twice recipes to inspire you.

Meal planning will save you so much money and it’s healthier for you. That’s a win-win.

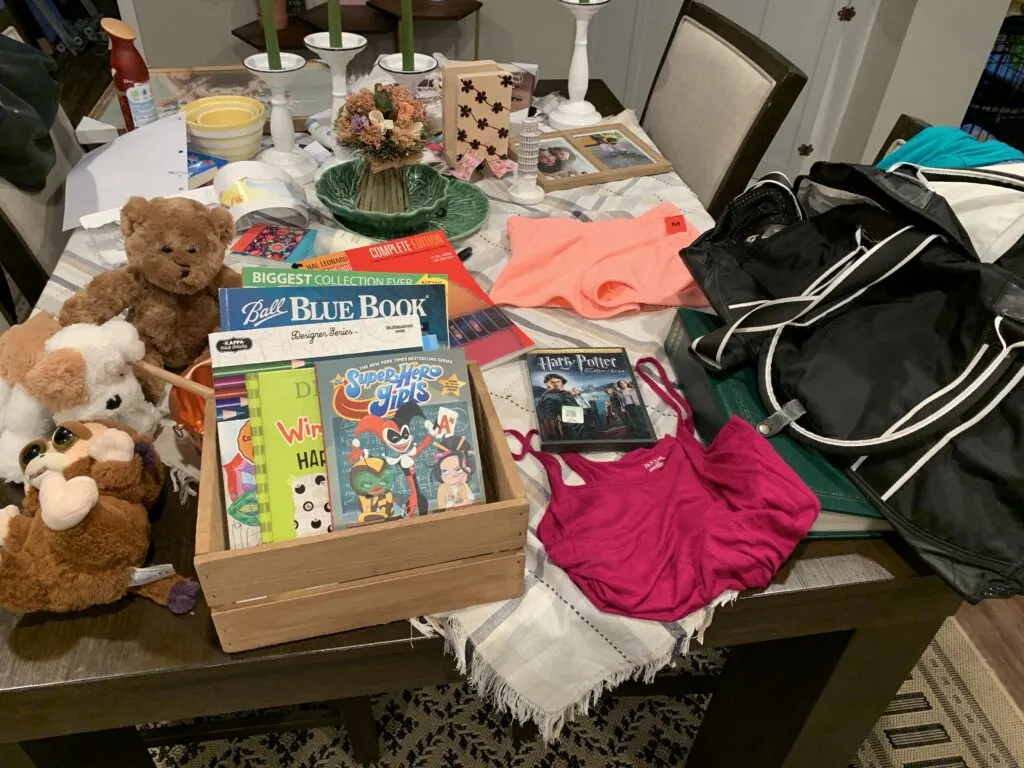

4. Shop Secondhand

Who said secondhand has to mean second best? Shopping at thrift stores or online marketplaces can save you a bundle. I once found a designer dress worth $200 for just $15 at a thrift store.

Talk about a bargain! ( Follow me on Instagram and TikTok for those finds!)

If you are new around here check out my post on Goodwill bin shopping! If you have one of those near you, it can change your savings game dramatically.

5. Automate Your Savings

Last but not least, automate your savings. Set up a direct transfer to your savings account every two weeks. This way, you’re saving without even thinking about it. Plus, it makes the Bi-Weekly Savings Challenge a breeze.

So there you have it, folks. Saving money doesn’t have to be a chore. With these hacks, you can make the Bi-Weekly Savings Challenge not just doable but enjoyable too.

So why not give it a try? And remember, every penny saved is a penny earned. Or, in our case, a penny towards that dream vacation, new car, or whatever your heart desires.

Happy saving, my friends!