It’s a sad fact that most people aren’t just lacking wealth; they’re burdened by debt, not making enough money, and suffering from anxiety over their finances. For some, it will always be a struggle.

They’ll never learn how to eliminate what they owe and earn enough money to experience wealth in their lives. That could change if they made an effort – but they don’t.

Some of it’s due to ignorance about implementing a plan to offer them financial freedom. They simply weren’t taught about managing money and growing wealth.

Others are living in the mindset of instant consumer gratification – charging things and spending any leftover cash simultaneously. What happens to those people is they eventually get to a place where all minimum payments meet or exceed their current cash flow – and then there’s nothing left over and no credit available.

You want a life where you owe no one anything – a life where every bit of your money is either spent on basic necessities (like your electric bill), saved for the future, or used to allow you to enjoy life as you always dreamed it could be.

I went from a broke mom living paycheck to paycheck to financially free at thirty-five during a pandemic. I had no idea how impactful all those small decisions were to our financial freedom journey. We paid off over $55,000 in consumer debt, our farmhouse with 11 acres in four years, and last year, we bought our first investment property.

I’m here to encourage you no matter where you are in your journey; financial freedom is for you too.

The Shame of Being a Financial Cautionary Tale

Not having money (and not having good credit) can be such a shameful feeling. You might be beating yourself up about all the needless things you spent your money on – whether for you or to make someone else happy.

Or maybe you’re kicking yourself for not making the kind of money you always thought you would. You might be hanging your head in shame over financial ruin for a million reasons.

Every corner you turn, you’re met with something you need or want but can’t get because of the situation you’ve put yourself in. Maybe an emergency happens – like a plumbing catastrophe – and suddenly you need $5,000 to fix it.

You have two choices – finding the money or letting it ruin your home. But your credit cards are maxed out, the bank won’t loan you any money, and you have no one you can turn to who will personally rescue you from this situation.

Or maybe you’d love to send your kids on the school trip to France this summer – but there’s no way it will happen. You can barely pay tuition; every extra bit will pay the bare minimum on your debt load.

Having to tell a company you can’t afford to fix the plumbing (or get a car repaired, etc.) is embarrassing. Standing there with a stranger, acknowledging that you don’t have a penny to your name – and horrible credit to boot – is uncomfortable.

Having your child ask you if they can do something – even something simple that costs just a little bit – and having to say no because there’s no money – makes you feel like a failure as a parent.

After implementing this plan, you will feel better about where you are and where you’re headed. You’ll be able to hold your head up high because this is all about regaining control.

To date, you’ve been out of control. Whether it was caused by your bad decisions in spending or not earning enough, or something unexpected hit you that knocked you off your feet (like a medical emergency with tens of thousands of dollars in debt) – you’ll start taking back control today.

Related: This is my favorite way to start a household budget.

What Does Wealth Mean?

Wealth is different for everyone. For some, it means extreme riches – private jets, continual travel worldwide, and $30,000 a night hotel suites. That’s extreme – and most people don’t strive for that wealth daily.

Most people want not to owe anyone anything, to have ample money to set aside to keep them comfortable in their future, and to have cash left over to enjoy the here and now.

That is very doable!

Paying cash for everything you buy should be a top goal for you. That doesn’t mean you can’t have credit – even charging something and knowing you can write a check for it in full to the credit card company is like paying cash – you’re not paying interest on it, and you’re building or maintaining your credit along the way.

Having peace of mind that all bills will be paid on time (or before they’re due) each month will be a sign that you’ve achieved a certain amount of wealth in your life—no more late payments or living paycheck to paycheck.

No using one credit card to pay for another one. This is the juggling in your life that’s not fun. It leaves you feeling insecure and riddled with anxiety every day.

Knowing that each time money comes in, you have enough left to put some aside for your golden years (or even a vacation six months from now) is a sample of achieving great wealth.

Being able to say “yes” when you want to (and need to) and “no” because you’ve learned how to or because you know you should mean you’re now living the wealthy mindset.

Take a Hard Look at Where Your Finances Stand Today

It doesn’t matter if you’re at a poverty level or earning a seven-figure salary – that has nothing to do with wealth. Rich people can have trouble sleeping at night because they live outside their means.

And what’s “rich” anyway? Is it $80,000 a year? Six figures? Seven? To everyone, it’s a different number. You should always be striving to earn more and spend less.

You need to analyze your current financial state to get to a point where you even have options. Nobody else is looking at this, so you need to be brutally honest with yourself.

If you’re broke and juggling bills and see that you’ve been spending $3 a day on Starbucks, you’d better have it written down. If you’re not ready to get real and raw and see your finances for what they really are, then you’re not prepared for wealth building.

Dave Ramsey always encourages his listeners to live on rice and beans during the debt payoff portion of their lives. He says, “You need to live like no one else so that you can live like no one else.”

That means you won’t be comfortable as you go through this process. It’s going to be complicated. It will stink saying no to yourself and your family – because, for years, maybe you were always saying yes (when you shouldn’t have been).

But when you emerge debt-free, you know what’s going to happen? You will be in the minority of people who have achieved true wealth. They spend less than they earn, owe no one anything, and have cash to use for the lifestyle they really want to live.

Imagine paying cash in full for a brand-new car or buying a cash home! Want to get a pool installed in your backyard? While everyone else in the neighborhood is financing it for 15 years, you whip out your debit card and pay…cash.

Living that kind of life will be an indescribable feeling for you. But first, you have to see what your starting point is. When you analyze your debt and bills, ensure you know where every penny goes.

You might have to check your bank statements if you haven’t kept a check register carefully. Make a spreadsheet or even pen and paper and organize your monthly spending.

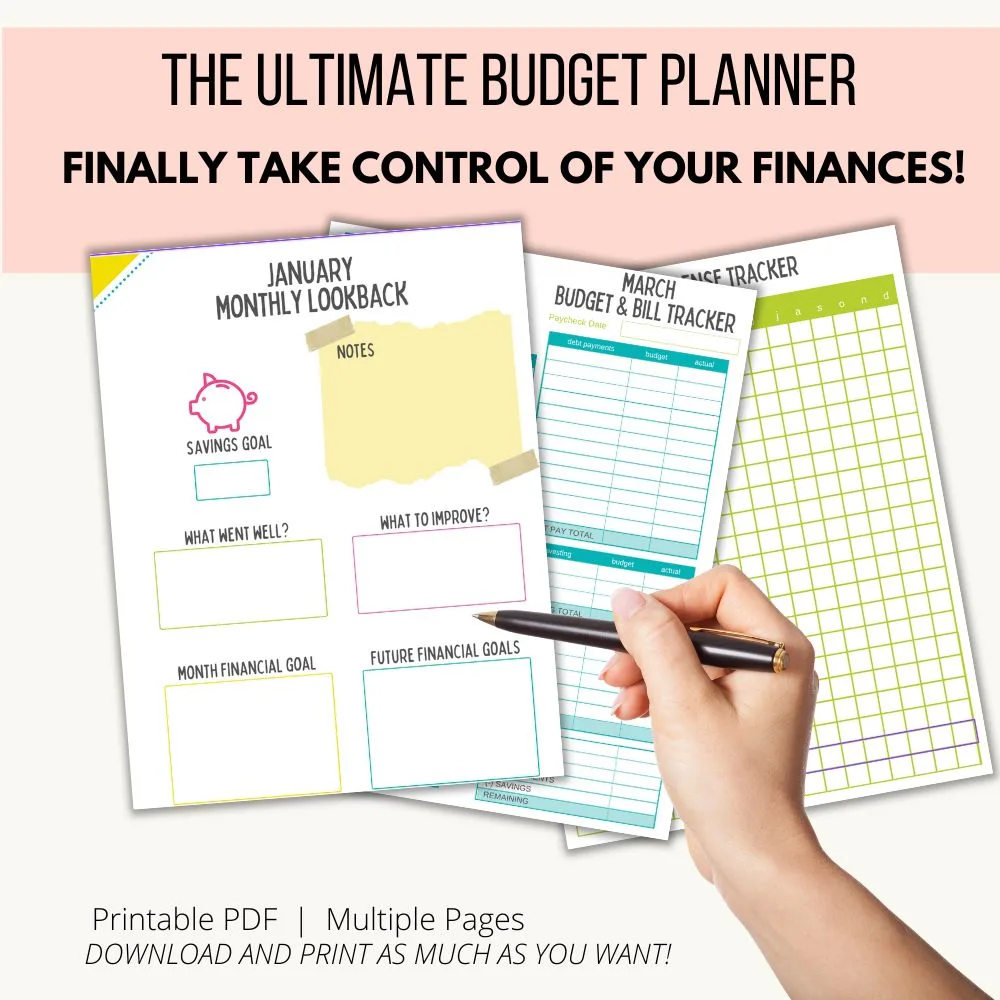

This is my favorite easy-to-use Budgeting Binder.

Separate your lists like this:

- An area for your monthly house bills

- An area for consumer credit cards

- An area for other debt (medical, school, government, etc.)

Your monthly bills could be your mortgage, electric, phone, car, groceries, gas, Internet service/cable, etc.

Your consumer credit card debt is all your credit cards – such as Visa, American Express, Mastercard, Discover, and other specialty cards like store cards (Target, Kohl’s, etc.).

Under your “other” debt category, list all of your debt – like any IRS payments you make, payments to any medical companies for procedures you’ve had done, school loans or tuition owed, etc.

How do you organize each list?

For monthly household bills, list the name of the debt, how much it is approximately each month, and what date you have to pay it. For example:

- Mortgage $1,200 4th of the month

- Electric $300 7th of the month

- Phone $175 10th of the month

That way, you know what’s due, for how much, and when. If you notice that everything hits you the first week of the month, and you get paid twice – on the 1st and the 15th, then you might contact a few of your companies and ask for a change in the due date.

Most companies will comply with this request. Try to space it out so that you’re not pooling all debt payments in one or two weeks but have time throughout the month to get them paid.

With the second group – consumer debt – you can copy this into three lists. The first list will be organized according to the highest interest rate first, all the way down to the last. That might look like this:

- American Express $798 owed 4th of the month 29.99%

- Mastercard $568 owed 1st of the month 26.00%

- Visa $1,519 owed 10th of the month 16.00%

Another list of the same debt can be organized according to the amount due – from least to most lavish.

- Mastercard $568 owed 1st of the month 26.00%

- American Express $798 owed 4th of the month 29.99%

- Visa $1,519 owed 10th of the month 16.00%

The last group of exact debt can be organized according to how much is available on your card. You’ll need to call and get the amount available and the debt owed on all of these to have exact amounts for your analysis.

- Visa $1,519 owed $100 available 16.00%

- American Express $798 owed $550 available 29.99%

- Mastercard $568 owed $2,500 available 26.00%

We’ll review what you will do with this information soon. The thing we’re doing now is just information gathering. But you’re not done yet. There’s one last hard step you have to track.

Wasteful spending

Yes, you may have put things on your credit cards that are considered waste, too – but let’s look at your cash flow and other places you spend money. This might include places where you use cash or your debit card for:

- Fast food (breakfast, lunch, dinner, coffee, ice cream, etc.)

- Going out (dinner, movies, and events)

- Entertainment and shopping (new books at Barnes and Noble, new clothes, etc.)

Anything not a household bill, consumer credit card debt, or other debt is often wasteful spending. That doesn’t mean all of them are. For example, you might pay cash for a co-pay at your doctor’s office. That’s a necessity, and it’s wise to pay for it in cash rather than put it on a credit card, which will rack up interest.

So go back about 1-3 months and see where you’re leaking money so that you can be aware of it and end the poor spending habits you’ve created over the years.

Spending Less Is Your First Step Toward Freedom

Right now, you might be feeling the pinch with your bills – maybe living paycheck to paycheck, and you’ve already cut down a great deal. Perhaps you’ve let go of the weekly date nights to dinner and a movie, or you quit splurging on new clothes every month.

That’s a great start – but whatever you’ve done so far, it’s not enough. You can go farther – make it uncomfortable for you. Some people worry about changing the lives of their families.

They feel guilt for getting into this predicament, so they don’t want to suddenly yank away the comfort that their spouse or kids have come to enjoy over time. If this describes you, it’s time to get the whole family onboard (and excited) about your financial freedom plan.

Tell them about how you really want to change your lifestyle for the better.

Talk about how much better it will be when your family:

- Can pay bills weeks ahead of time

- Doesn’t have to forego things because the paycheck’s already stretched too thin

- Can put money back for planning vacations and other fun family purchases

- Has money saved for college for every child

- I can spend more family time relaxed and happy because less time is spent stressed out from working so much

Not all of your family will be pleased when they find out what it takes to achieve those goals.

No one likes to give up things they’re accustomed to having – but let them know that once debt’s all gone, you’ll sit down as a family and re-evaluate what you want to spend money on, and some things can come back into the mix since you’ll be able to afford them better.

What are some things that need to go or be cut down on?

We typically max out cable television plans without even paying attention to what we use. You might have been talked into a plan that gives you every possible movie channel you could imagine – plus special packages like sports.

Or you’ve cut cable, but now you have ten subscriptions for watching different TV shows.

Cut back to the basic cable plan and/or the ONE streaming network for a while. If you want to watch shows and it’s an essential part of your family entertainment, then you have a few options that can cost much less, such as:

- Hulu

- Netflix

- Amazon Prime

You can cut down from $255 a month to $40 for basic cable – and add on a Netflix plan for $8 and save a tremendous amount! You might have to watch a bit to see the latest episodes, but that’s a sacrifice that needs to be made.

( For the best streaming deals check out this post)

What about your phone bills? Do you have both a landline and a cell phone? Do you need both? If not, get rid of one. What’s on your cell phone plan? Some companies charge $10 a month for insurance – and a family of five is paying $50 a month just to be insured.

With many of those plans, the deductible is another $50-100 per phone, so you might save money just by putting aside enough to replace one phone (just in case) and using the rest to pay off debt.

You can also choose a lower plan and limit everyone in the family. If you spend $50 per phone for data charges (Internet), get rid of it.

If you have a plan that gives you unlimited texts and calls, then switch to one that costs less and gives you less (just make sure everyone understands how many minutes they get).

Have you refinanced your mortgage lately?

You might want to look into it with interest rates being so low. You can get a lower house payment and either finance it for exactly what’s owed or take out a home equity loan and put that extra money toward a higher interest-rate credit card.

Look at your car insurance premiums

Call them and ask what discounts they offer. You can save money with good grades (for students) by taking a defensive driving course, etc.

Also, consider lowering your coverage temporarily

Please don’t put yourself at risk, but sometimes we take out far more insurance than we need. Your insurance company might give you a lower rate if you drive fewer miles yearly, too – so make sure you track that!

Do you order the local newspaper to be delivered to your home each day? Do you really need it, or can you watch the news or read it online? You can shave about $40 a month off your bills if you let go. Maybe it’s not the newspaper but any other subscription coming to your home.

Once you eliminate the “fat” in your budget, you’ll feel much better and realize how much you didn’t need those extra elements in your life. Much of what you spend money on is your routine.

You wake up and read the paper over coffee – that’s a routine, not a necessity. So what if you’re surfing the web for news rather than holding a print version? You can make the sacrifice for financial freedom if you want it.

Create a Plan to Pay Off Your Debt

Everyone will offer a unique view of how they achieve financial freedom. Some will say to get rid of everything, close every account, and pay off the highest interest first.

With this plan, you’re going to have options. Get rid of as much as you can where you’re uncomfortable – but not to the point where you’re depressed. If you suddenly take away all TV, all Internet, and all phones, for example – well, it will cause you and your family to sit around feeling down in the dumps.

You want to enjoy life as you pay off debt, but learn to enjoy it less. Now, it’s time to start attacking the debt you’ve gained. This is separate from everyday monthly household bills.

First of all, don’t close cards that are already open. Part of where your good credit comes from is in the length of time you’ve had credit and your debt-to-availability ratio.

If you have a card you opened 15 years ago, that looks good. If it gets paid off and gives you 100% credit availability, that looks good, too. If you close that card, you lose the longevity and the 100% available balance that shows you’re not all maxed out on your credit cards.

At the same time, don’t order new cards with lower interest or combined debt. Your credit score will lower when you apply for new cards, so let’s work with what’s already there and learn how to manage it.

Remember those lists we made where we organized debt earlier? We made one where we ranked our interest rates, listed it according to the lowest to highest amount owed, and ranked it according to the amount available on our card, from lowest to highest.

This is where you have choices. Some people recommend paying off the cards with the highest interest rate first. Others will use the Dave Ramsey “debt snowball” approach, where you pay off the card with the lowest remaining debt and use the minimum payment you were paying to that card on the next lowest debt.

This method is excellent for momentum and enthusiasm. Cards with high interest rates might take longer to pay off (depending on your balance), and the confidence boost that you get from paying off a smaller debt and having another card paid off in full helps you feel great about this process.

The third method you can use is paying off the cards with the lowest amount available. You want credit reporting companies to look at each card and see a healthy ratio – far less owed than what’s available.

Run your free credit report from each credit bureau annually. Contrary to popular belief, you don’t get your free credit report at freecreditreport.com – you get it at https://www.annualcreditreport.com/cra/index.jsp, and you’re allowed to run it once a year.

You might also want to order your credit scores occasionally to see how your credit is going. As your credit improves, you can call each company and ask for a lower interest rate and higher credit limit.

The lower interest rate will help save you money because you won’t pay as much, and the higher credit limit improves your debt-to-availability ratio. When you run your credit report, it will tell you the negative things that might impact your score.

It will tell you which factors have helped raise and lower your score.

Things that you might have done that will help your credit score include:

- Making all of your payments on time

- Having a variety of credit cards so that your lenders can see how you manage spending

- Maintaining good standing on a mortgage that proves your ability to handle financial obligations

- Not having any public records like bankruptcies, liens, or court judgments against you

There might be a few things working against you, such as:

- Having more debt on your credit cards than available credit signals that you’re forced to live off your credit cards.

- Having too many inquiries for new lines of credit on your report

- Having low credit lines extended to you

You want to aim for debt on a card totaling no more than 15-25% of what’s available. But try to pay it all off in full every month once you’re debt-free so that you hold a zero balance.

Having low credit lines shows them that you’re not yet being trusted with significant limits, and the critical factor they’re searching for is responsibility.

When you run your credit report, see what’s being held against you and work on repairing that first. If you’re not making timely payments, focus on that before anything else. Then, work on other factors, like making more available on your cards.

When making all payments on time, it will be time to start figuring out which route you want to go with your debt. Everyone is different – would you love the inspiration of seeing one credit card paid in full sooner – or would you prefer to know it might take longer, but you’re paying off the highest interest rate first?

Sometimes, you can look at your three lists (if you have a lot of debt listed) and find something ranked near the top that fits all three criteria – low amount owed, low available credit, and high interest rate.

Paying that off first will help boost your credit and give you a boost in knowing that you’re also making progress. You can switch it up along the way, too!

Nothing set in stone says you have to stick to just one method. Remember that this is good if you and your spouse disagree on strategies. Take turns.

Pay off the highest interest rate first, then the lowest balance next, and then the lowest available credit last. Rotate the strategies if you’re unsure which one you’ll feel better about.

Everything left over after necessities and other items will go toward debt. Don’t leave a big cushion of cash sitting in the bank when you could be paying off the debt that you owe.

Let’s Break it Down

So, let’s say you get a paycheck of $1,000 (for a nice, even number). You have bills that total $500 for the home expenses and other debt minimum payments – you always want to take care of those first, above everything else.

Now you have $500 left over. If you have a credit card totaling $477, pay it off in full. Put it on a new list called “RIP” or “Paid in Full.” When you start seeing this list rival in size to the “debt owed” list, you’ll feel really powerful.

Put the $23 you have left from that payoff and bill-paying session toward your “other debt” list. If you owe $140 left on a medical procedure bill, that $23 will help whittle it away quickly.

Don’t keep the $23 as a “free pass” to go do something fun or return to your wasteful spending habits. Use every penny left over toward debt. Even if you have an extra $5 left – send it into something.

See if your bank has a free “Bill Pay” system where they will send your payments off for you (no stamps or checks required). This makes it easy to squeeze every last drop of your earnings toward debt.

You’ll notice that your “minimum amounts due” start to decrease. This leaves you with more money every month to pay off more debt. If you pay off two credit cards with $25 a month minimum payments, that’s $50 extra you can put toward another bill.

You’ll also notice that you stay well ahead of your due household bills. But keep wasteful spending at bay until the debt’s paid in full. Once everything’s paid off in debt, monthly bills are made with ease, and you’re saving for what you need to save for, you can have fun with whatever’s left over and indulge in trivial things.

Some people keep going and move on to pay off their car and house, while others leave this as a part of their regular monthly payments that have to be met.

It feels good to make that last mortgage and car payment – and it significantly boosts your credit score when lenders see that you’ve managed to pay off a large debt to your creditors.

Learn to Save Instead of Spend

After you’ve slain the debt dragon, you’ll want to learn how to start putting some money away for things that previously caused you to go into debt. That might include:

- Christmas

- Birthdays

- Car repairs

- Emergency household repairs

- Retirement

- Medical emergencies…etc.

You can make separate bank accounts for these or save them in cash – whatever you prefer. Dave Ramsey suggests you have the emergency savings first – before even going through your debt payoff process.

You can do it that way – or pay off one of your credit cards to hold as an emergency card, which helps you boost your credit score simultaneously. The choice is up to you.

Create a particular chart of percentages you want to put toward everything – and set amounts for it. Let’s use our previous example of the $1,000 paycheck.

Now, you still have $500 in monthly bills – but the leftover $500 is no longer required to go toward debt!

You can split that up with percentages or set amounts. For example:

- $25 to Christmas – up to $300 per person

- $25 to Birthdays – up to $500 total, including party

- $50 for Car repairs up to $1,500

- $100 to Emergency household repairs – up to $5,000

- $100 to Medical emergencies – indefinitely

- $100 to Retirement – indefinitely

That leaves you with $100 a paycheck (even more once you reach your maximum goals) – all for frivolous things like eating out, entertainment, etc. Once you reach your goals on the smaller savings, you can put more toward your indefinite savings and more toward what we previously labeled “wasteful spending.”

It’s only wasteful if you’re going into debt or stretching yourself thin financially. After you’re financially secure and living with a wealth-building mindset, you can spend any leftover money on whatever you want if it makes you happy.

Make Progress Toward Earning More Money

When you arrive at this point in your financial freedom journey, you will have gone through the “buckle down” process and lived frugally.

You will have worked hard to pay off everything you owe – and you’ll enjoy looking at the small savings adding up to secure your future.

But there’s more to it than stopping there. Financial freedom means having abundant cash flowing in – enough that if you want to donate significantly to charity, you can. Enough that if you splurge on a big-ticket item, you don’t even have to hesitate!

You need to earn more money so that you have more to save and spend.

How can you do that? There are a few options – pick one – or even better – choose them all!

Ask for a Raise

If you work at a job for someone else, plan to get a raise in your position – or to increase your skillset so that you can go for a better job. It’s never too late to formulate a plan for a better salary.

Find Things to Sell

Many men and women make a full or part-time living selling things on eBay. Others provide services locally, like tutoring, handyman tasks, and more. Look at your talents and see if they have a local or global market.

Make Money Online

Aside from eBay, there are other ways you can make money online. For example, you can write books (fiction or nonfiction) for Amazon Kindle. This is a no-cost solution to wealth building and even debt payoffs.

You can provide services online that people will pay for, such as ghostwriting, website building, graphics, and even virtual assistant services. Find sites like Elance.com, where freelancers build a dedicated list of clients.

Rewarding Yourself with Wise Spending Decisions

After you’ve begun wealth building – debt paid off, savings built, and earnings on the upswing – you can start enjoying the fruits of your labor. This is what life’s all about.

But don’t fall back on haphazard spending decisions. Remember always to get the best deal. If you buy a car – pay cash – and make the dealerships fight for your business with a competitive offer.

Getting free from your financial woes may feel like a lifetime away. But remember that you didn’t get here overnight. Don’t beat yourself up over how you got here.

Forgive yourself and be proud that you’re doing what most people will never do – look to see where you went wrong, fix it, and alter your behavior so that you’re doing what’s right – not just what feels good at that moment.

You might want to keep a diary of your journey to look back someday and see how far you’ve grown – not just in money, but in maturity with how you handle your finances.

You got this!