In today’s fast-paced world, there’s been a lot of talk about being frugal. It’s a topic that has gained popularity in media and around the web, especially since the US economy took a downturn.

Living frugally has become a necessity for many of us. However, there are two common misconceptions about frugality.

The first is that people who live frugally are poor. The second is that people who live frugally are cheap and never spend money.

Let’s talk about what it means to be frugal, dispel some myths and misinformation, and look at what it means to live frugally.

Being Frugal Doesn’t Mean You’re Poor or Cheap

Living frugally doesn’t mean you’re poor. It seems most of our culture can’t accept that if you don’t have a big fancy house, you must not have money.

I’ve gotten wild comments from people telling me I’m not frugal because of my choices.

For example, someone commented I’m not frugal because I shop at a grocery store. If I were frugal, I would have all my food from my own land.

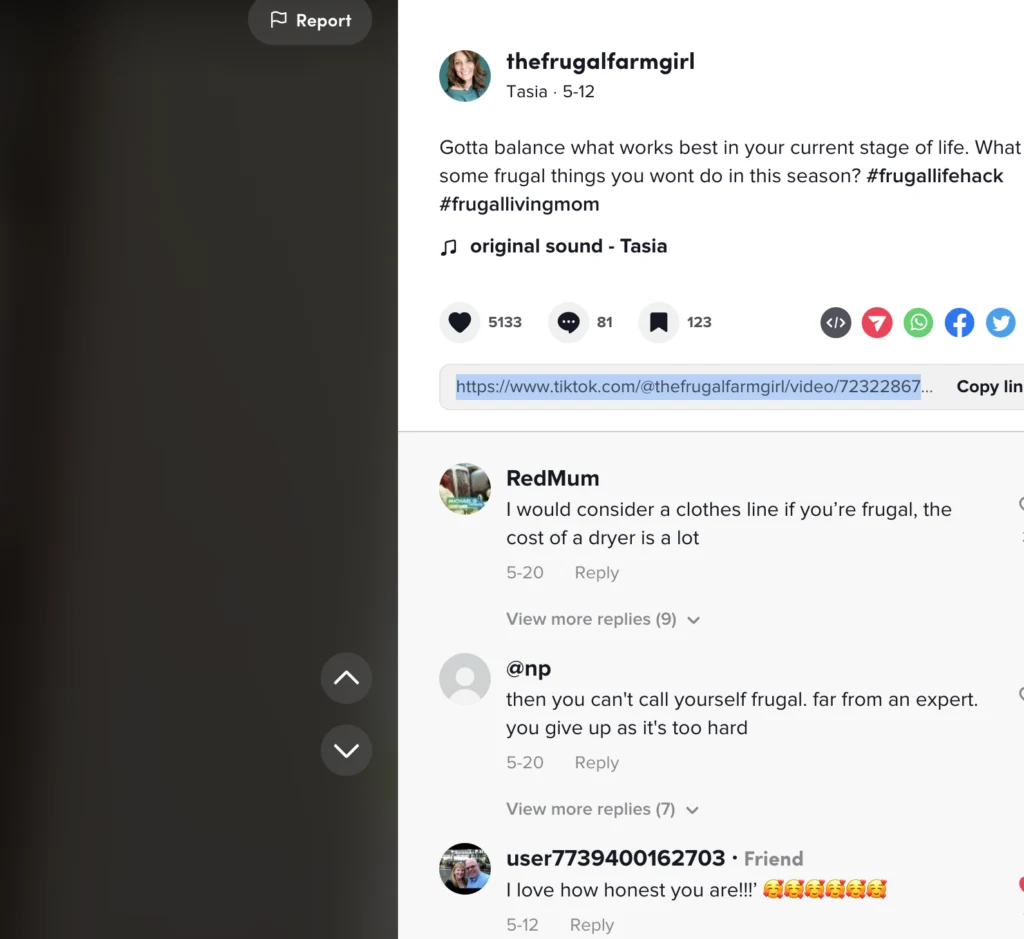

The latest one that is interesting is on Tiktok on a video I shared about Frugal things I don’t do as a frugal living expert.

The comment was that I’m not frugal because I dry my clothes in a dryer, and I’ve given up. I do not believe that is what frugal meaning is.

Here’s the video if you are curious.

Frugal means you’re smart with your money and use it wisely. Frugal people are not drowning in debt; if they do have debt, they are working to pay it off, and their bills get paid on time.

Yes, you can live frugally on a small income ( we did it!). They choose to live well below their means and spend money on what’s important to them. This means they aren’t keeping up with the Joneses.

Being frugal also doesn’t mean you’re cheap, and spending money never happens. Not having the biggest house on the block or the fanciest car in the neighborhood doesn’t make you cheap; it makes you smart.

When you’re being cheap, you make hasty decisions based solely on cost. But when you’re being frugal, you might give up impulse shopping at Walmart and use the money for your new roof or save it for a future need.

When you’re a frugal spender, you consider all the consequences of your purchases. You think twice before you spend every dollar.

Being Frugal Means, You’re Smart About Spending

When it comes to being frugal, it’s all about making smart choices for your spending.

Being frugal means being intentional with where and how you spend your hard-earned cash, often taking some planning ahead of time. Remember that the benefits of frugality extend beyond saving money; it can also help you prioritize what truly matters in your life.

It could be a fun trip with loved ones, a down payment on your dream home, or maybe just staying home with your kids.

The options are numerous when you embrace frugality. So, it’s not only a matter of saving money but an opportunity to fulfill your dreams.

Spending Money

Managing your money and living below your means is not always easy, but it does GET easier as time goes on.

It all depends on your income and financial goals in the beginning. When we started our debt-free journey on one income, we had to do spending freezes. I couldn’t head over to TJmax spending freely on clearance items.

Looking back, I’m thrilled that I made smart, frugal choices with my money. I’m glad I didn’t cave into the temptation of buying things that would be sitting in a donation center right now. Now, I’m happy to say we have zero debt!

There will be times I’ll be going to someone’s house for the first time, and it’s gorgeous. New and remodeled, and I’ll think for a second, I want that.

But after years of practice and seeing how amazing financial freedom is, I’ll think about how functional, cozy, and great my own home is, and the best part is- it’s all paid for.

We might live in a materialistic world, but let’s not forget that we’re all human. There’s always a choice not to fold under pressure.

7 Tips on How to Be Frugal

1. Set a Budget

Setting a monthly budget is the first step in living a frugal lifestyle. Knowing how much money is coming in and going out will help you make careful decisions about your spending. It will also help you to identify areas where you can cut back.

Identify your financial goals:

Before diving into the budgeting process, take some time to reflect on your financial goals. These could include saving for a vacation, paying off debt, or building an emergency fund.

Write down your short-term and long-term goals in the budgeting binder. This will help you stay focused and motivated as you work towards achieving them.

Create categories and allocate funds:

Start by listing all your income sources and expenses in the binder. Break down your expenses into categories, such as housing, groceries, utilities, transportation, and entertainment.

Allocate a specific amount of your income to each category, ensuring that your total expenses do not exceed your total income. This will give you a clear understanding of where your money is going and help you identify areas where you can cut back or make adjustments.

Track and evaluate your progress:

Regularly update your budgeting binder with your actual expenses and compare them to your planned budget. This will allow you to identify any discrepancies and make necessary adjustments.

Review your progress toward your financial goals at the end of each month and celebrate any milestones you’ve reached. If you’re consistently overspending in a particular category, consider revisiting your budget and making changes to better align with your goals.

Using a budgeting binder can be a simple and effective way to take control of your finances and work towards achieving your financial goals. By following these tips and regularly updating your binder, you’ll be well on your way to financial success.

If you are living paycheck to paycheck and are sick of the cycle, you must consider how to make more money. Try these tips.

To help you get started, grab my Budgeting Binder here.

2. Track Your Spending

Tracking your spending will help you to see where your money is going. It will also help you to identify areas where you can cut back. Use a budgeting binder or an app to track your expenses.

A budget will force you to look at everything you purchase and give you a sense of what is wasteful and costly.

Here are a couple of examples of wasteful and costly expenses.

Daily takeout lunches

Many people enjoy the convenience of grabbing a meal from a restaurant or fast-food joint during their lunch break. However, this habit can quickly become a significant expense.

If you spend an average of $10 on lunch every weekday, you’re spending roughly $200 per month, which adds up to $2,400 per year. To reduce this expense, try packing your lunch at least a few times a week. Homemade meals can be more cost-effective and healthier.

Set aside time each week to meal prep, and consider investing in a quality lunch container to make bringing your lunch more enjoyable.

Streaming service subscriptions

With the rise of streaming services, many households have multiple subscriptions to platforms like Netflix, Hulu, and Amazon Prime. While the monthly cost of each service may seem reasonable, having several subscriptions can add up.

For instance, if you pay for four different streaming services at an average of $15 per month, you’re spending $60 per month, totaling $720 per year. To save money, evaluate your usage of these platforms and consider canceling any subscriptions you don’t frequently use.

Also, do not forget to cancel any free trials you signed up for.

You can also look into sharing accounts with family members or friends, as many services offer multiple user profiles and simultaneous streaming options

3. Make a Shopping List

Making a shopping list before you go to the grocery store will help you to avoid impulse buys. Stick to your list and avoid buying things that are not on it.

Grab my Meal Planning Binder here to help you get started with this.

4. Cook at Home

Cooking at home is a great way to save money. It’s also healthier than eating out. Plan your meals and make a grocery list. This will help you to avoid buying unnecessary items at the grocery store.

5. Shop Secondhand

Shopping secondhand is a great way to save money. You can find great deals on clothing, furniture, and household items at thrift stores, consignment shops, and garage sales.

6. Use Coupons and Discounts

Using coupons and discounts is a great way to save money. Check your local newspaper and online for coupons and discounts on what you need.

7. Cut Back on Utilities

Cutting back on utilities is a great way to save money. Turn off lights when you leave a room, unplug appliances when you’re not using them, and adjust the thermostat to save on heating and cooling costs.

Living frugally doesn’t mean you have to sacrifice your quality of life. It means being smart about how and where you spend your money.

By making a few changes to your spending habits, you can save money and enjoy the important things to you.