Keeping a low grocery budget was easy four years ago with all the coupon deals. Fast forward to all the apps and coupon fraud. It’s a different ballgame today. One, I’ve found a way to still master minus all the coupons.

Have you wondered how much you are supposed to spend on groceries? Here is a grocery budget calculator and practical tips to help you find the right budget for your family.

It was keeping to a strict grocery budget that helped us pay off our debt. Even now, I share my $60 grocery shopping trips. The key point I want you to remember is that it’s not a grocery budget competition.

I share my posts to inspire others to look at how they can cut back the grocery bill for their family.

My family size is 4. Someone with a larger family will have a different budget. Throw in dietary needs, and it’s a game-changer.

I want you to remember that no matter your family size, there are ways to cut back your grocery bill.

When I talk about budgeting, it’s important to look at how you can change the weekly amount.

For example, you can’t pay less on your mortgage or rent. That’s a set number every month.

The same goes for most utility bills. So yes, you can try these ways to cut back your electric bill. Yet when the bill comes, you must pay it.

With grocery and shopping for items we need in our home, we can change the amount.

We have the power to control how much we shell out for stuff. We can look at home decor items as wants instead of needs.

The key to keeping a grocery budget that works for your family is to start by living below your means in all aspects of your life.

If you can learn to spend less than what you make a week, you will be walking down that financial path to freedom much faster.

Even though everyone will have a different grocery budget, there aren’t tips to help you determine what your grocery budget should be.

Let’s look at five tips to help you decide what your family’s grocery budget should be.

Here is a great discussion video on Tiktok where others share their grocery budgets and tips.

Let’s look at a stat from the USA today on grocery budgets.

According to the U.S. Department of Agriculture, Americans spend, on average, around 6% of their budget on food. However, the study also shows that they also spend 5% of their disposable income on dining out. That makes your food budget 11% of your overall income.

USATODAY.com

How to Calculate Your Grocery Budget

The first thing you need to do is find out how much you are spending on groceries. Then, decide if you want your grocery budget to include only food or food and household items like toilet paper, shampoo, etc.

I keep my two budgets separate. I buy almost all of our household goods at Costco or BJs, and I’m going monthly for these items. When in a pinch, I know I can always get toothpaste and shampoos for under $1 if I check out the weekly coupon deals. If you eat out frequently, it would be easier to add this to the food budget.

You can use the Grocery Budget calculator below that uses the (USDA) Low-Cost Food Plan. And read on for tips on how to actually achieve this grocery budget.

Use a Spreadsheet

I suggest using Google Sheets Monthly Grocery budget. It’s simple to fill in, and you’ll have access to it anywhere. Me, I love using my Google docs on my phone and desktop.

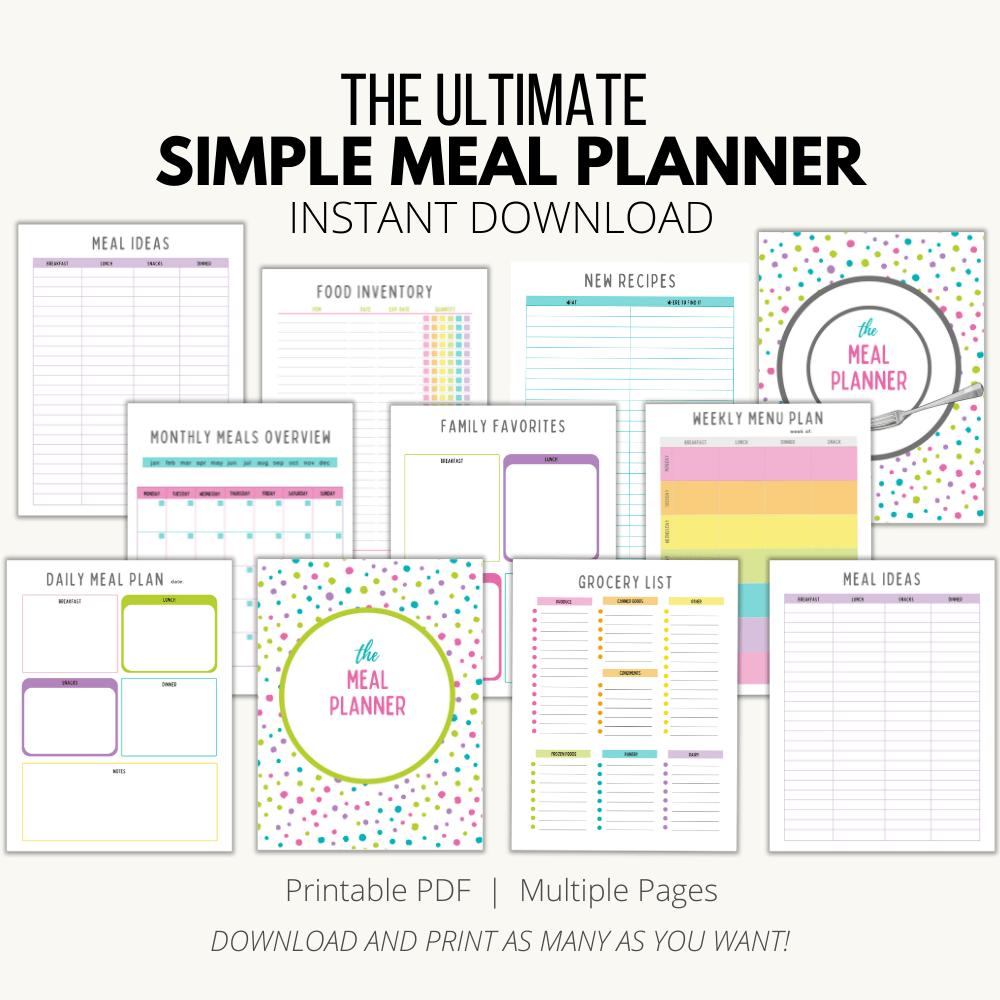

If you aren’t a tech savvy person and want printables I have an awesome Meal Planning Printable pack for you!

Make a grocery list BEFORE you shop.

If you need tips on how to make a money-saving list read this.

Keep EVERY receipt.

This also gives you the chance to really look at how much each item costs. Sometimes I’ll bring home a grocery receipt and see the dollar amount for something like fresh bakery buns and think $5 for 6 buns? When before, I would put it into my cart, assuming buns are cheap. (Nope, not Wegman’s Bakery Buns!)

Then get two highlighters. Mark everything you bought that was on your list with highlighter A. Mark everything that wasn’t on your list with highlighter B.

This will help you see where you can save money. Were the kids with you begging for those granola bars that were not on sale? Next time see if you can leave the kids at home.

Take a good look at the why for the items you purchased not on your grocery list.

- Use Ibotta and Fetch Rewards to earn money for things you are already buying.

Pick a Time to Shop With Little Emotions.

We’ve all emotionally shopped at one point in our lives. Sometimes it’s not even something we typically think of. However, many of us can agree we’ve been stressed out, and junk food or ice cream calls us over.

In it goes. Bad days turn to food that makes us happy.

Also, think about the grocery items you are buying because you think you’re supposed to. When I was a new mom the first couple of years, I had my girls; I thought they had to eat everything healthy and low sugar.

I was buying organic items, but no one in my family was eating. Not even me. But it brought about an emotional confirmation seeing them in the cupboard.

Leave all emotions out of this grocery tracking month. But, if you are struggling with emotional spending, check out my article all about it here.

Track your spending for at least a month. After you’ve tracked it, take a look at the numbers and see if you need to lower them.

At the end of the month, reflect on what went on with your grocery bills.

Why were some weeks higher than others? On those higher amount weeks, what could you do differently to decrease the food budget?

Calculate Time & Savings

Today grocery pickup is taking off because many of us are trying to find more time in a day. However, the reality is we all get the same 24 hours every single day.

If you find meal planning and shopping from the local ads and tossing in coupons use too time-consuming, your best bet is to look into grocery pickup.

Many stores do not need extra if you pick it up. However, when you choose to have your groceries delivered, you will pay more.

You can do grocery pickup with BJs Wholesale club. This would come in handy for all those bulk items you don’t want to squeeze in a shopping cart.

Find out if your family has more time or money to spare. For most of us, we are trying to pay off debt or live below our means. If we don’t have the extra money, we need to find the time.

Suppose you can’t coupon, at least meal plan. Meal Planning is the easiest way to help with keeping a low grocery budget.

If you want to see a thrifty, low-cost meal plan, check out this one from USDA.

And remember, my $60 a week grocery shopping is extreme, BUT it’s also because I’ve stockpiled and shopped from my pantry first EVERY time! We also rarely go out to eat.

Remember, everyone’s grocery budget is going to be different. There isn’t one right amount.

If you start grocery shopping to stock up your pantry so you’re able to cook meals at home on the fly, your first few grocery budgets will be a little more. This is important as to why you need to do a grocery budget for a month.

If you hit some great deals along the way and you end up with money left in the grocery budget, decide right now where the extra money will go.

Will it go to next month’s budget? Will it go to savings? Debt?

It’s important to know where every dollar is going. If not, you may spend it on something you didn’t really need or didn’t help meet your financial goal.

Talk About Your Why

Why is it important to set a grocery budget? Do you feel like you spend too much but you aren’t really sure?

Are you struggling to make ends meet? Ask yourself the tough questions and keep your why in front of you.

This way, when little hiccups come along, you can center yourself back onto why you are doing this.

Make Sure Your Why Makes Sense.

What I mean is if your finances are in order and you are happy with your grocery budget, don’t start going into grocery competition because your neighbor is only spending $60 a week and coupons all-time.

Look at your unique situation. For example, are you working full time? Do you have access to grocery stores weekly? Learn to take inspiration from where you can. Use what will work for your family, and then add your unique spin to it.

Your grocery budget doesn’t have to look exactly like mine. In fact, it shouldn’t. But we can both agree we want to save money on groceries and feed our families for less.

When I look at why for our grocery budget, I think about how I want to provide my family with meals, I enjoy cooking for them. I also like a challenge to use up what we have before running out to the store and buying whatever sounds good.

Your Why Can Change

When I first started doing a grocery budget, my why was that we needed money to pay the bills without going back to work. It was an adjustment, and our need was crucial. Five years later, my why has changed. Our grocery budget has changed.

The thing that never changes for me is always trying to pay less and do more with what I already have.

Your why will change. That’s okay. Your grocery budget will change. As our families expand and grow, our budgets will too.

If you learn how to live below your means, you will let go of the fear of these changes. You’ll have systems and mindsets in place, allowing you room in the budget. You won’t have to let your grocery shopping stress you out.

If you are new to meal planning, sign up for my free meal planning guide to get you started on paying less for groceries today ~

MORE RESOURCES: