Frugal living has become all the new rage. Okay, minimalism has, but not everyone fits that lifestyle. Yet, we can all benefit from what they offer.

When you think of frugal living, think of living in a way to save money. However, if you think about daily habits to save money, you will be surprised by how exciting the end of the year becomes.

A frugal lifestyle may be the exact change you are looking for. It can cut back on your spending, allow financial freedom, and more.

My husband and I have been a frugal living couple since we met. I remember when I was still in college, he was out working a “real job.” He still works there! He had bought an old beat-up truck from a friend for $500. He couldn’t even make a full payment to the guy for it.

It took three payments to pay it off. But at 20 years old, he did it.

It was a time when I had a beater car myself. An Oldsmobile that was on its last leg. I had to hope that I didn’t get stuck at a red light for too long, or it would stall out.

It was an ordinary day when we decided to go grocery shopping at frugal folks’ favorite store- Aldi.

At the time, Aldi only accepted cash, debit, or EBT card. We both had separate accounts since we were only dating. Our total was $40.

He swiped his card, and they denied it. Instantly my face flushed bright red with embarrassment. Then I felt proud to swipe my debit card.

Aldi denied it.

We had to leave our cart and tell the cashier we would go to the ATM and be back for it. It wasn’t very comfortable.

I knew right then and there I didn’t want this to happen again. Unfortunately, however, it did several more times.

We weren’t going out with friends every weekend; we were a couple of young kids making $6 an hour living in a place we couldn’t afford. We were paying $750 in rent a month. We only had enough to pay our bills. We didn’t realize we had to pay to feed ourselves too.

We turned our heat down to 60 degrees in the winter because the heating bill in that place was high. Even at 60, we were spending $200 a month.

Living a frugal lifestyle is fun. It’s not about being cheap. It’s about getting things for a better price. A price that fits your budget- not your lifestyle.

If you’re living a lifestyle you can’t afford what’s going to happen at the end of it all? We surely don’t bring our stuff with us when we die.

The thing I love about a frugal lifestyle is once you start, you never go back. Even if you have enough money to pay your bills and then enough to go out and give to others, you still want to use coupons, get a deal, and only buy a necessary practical item.

That doesn’t mean you won’t do fun things like taking the ENTIRE family to Disney on Ice. Or go on family vacations.

It’s all about balance, and it’s all about that budget.

Realize It’s A Lifestyle

You have to create a budget before you go any further. Right now, go on over here and fill it out. Please don’t put it off.

Just bookmark it or fill it in after this article. The cool thing about this is you can add everything right into the form. You don’t have to print.

*Tip there are a bunch of different budgeting forms here.

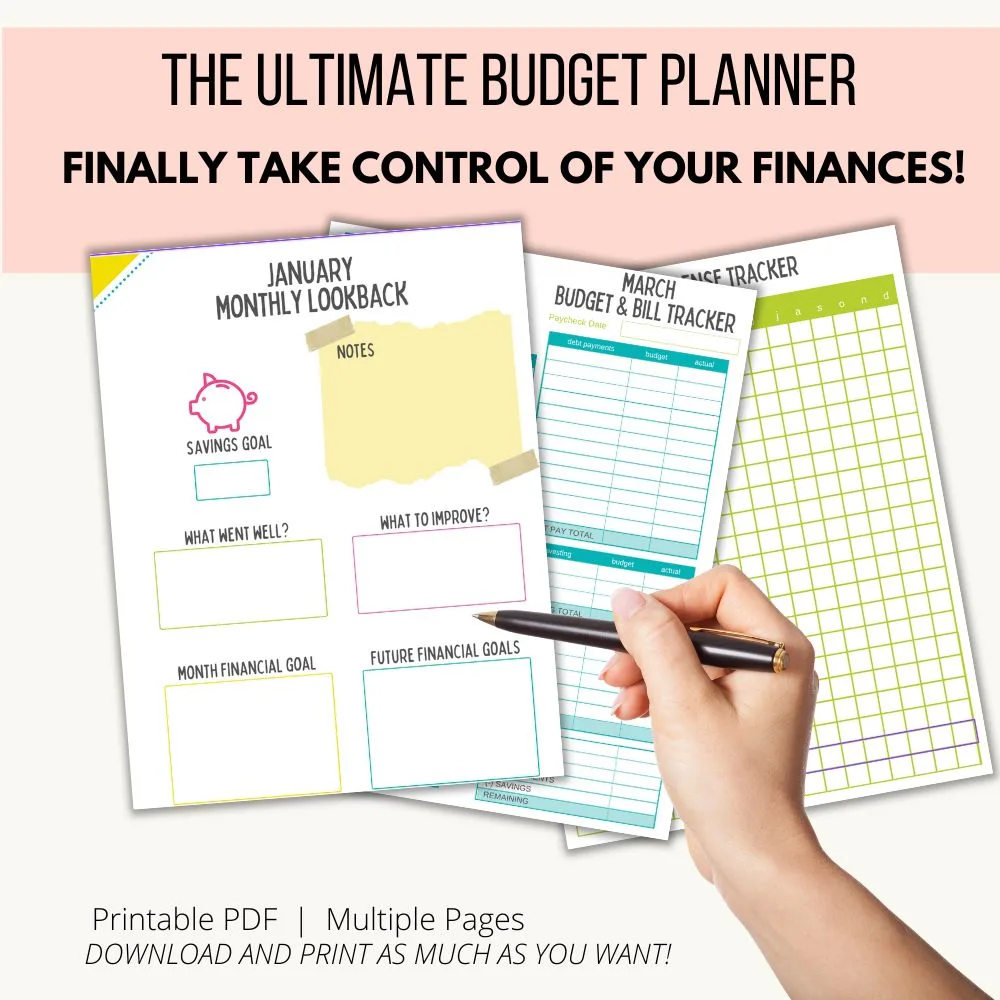

Once you have that budget, you need to look at your lifestyle. What are the things you have been misled into buying? Grab my Budget Planner HERE!

For example, did you need to buy that delicious-looking loaf of bread at the grocery store sitting on the counter?

Did you have to get that new phone? Did you need to get a brand new car? Did you have to go out to eat every night? Every Tuesday, Thursday, and Saturday?

The keyword is –have. The hard truth is you are probably short on cash because you are maintaining a lifestyle. Not a way to survive.

Set a Goal

Setting a goal is so beneficial. If you write one thing you hope to achieve in the next year, it serves as a reminder to help you get through difficult times.

Think about what it will mean to you and your family once you achieve it. Then, take a minute to set a goal and little things you can do to get there. Try a one-year plan, five-year goal, and 10-year goal.

I like to break my goals down into months as well. I write out ten goals for the month. The ones I don’t reach get carried over to the next.

Write down your smaller steps first that you can work on to achieve your main goal.

Here are a few questions to consider when setting your goal.

- What do you want?

- Why do you want it?

- What’s holding you back?

- What will you do to get it?

- How will you prioritize it?

- When is your deadline?

- How will you reward yourself?

Downsize your apartment/house payment

My husband and I didn’t have enough money to pay for our groceries because we lived in an apartment we couldn’t afford. So we chose to live in a popular place where rent was high.

When we got serious about our finances, we ended up moving out of that area and getting a bigger apartment for $150 less a month. But, sometimes, we get caught up in the “way it is” mentality.

We think it’s the way to live in an expensive place, but it’s not. So if your apartment or mortgage is too high, ask yourself, could we get it for less?

Get back to the basics.

It can be a humbling experience to get back to basic meals, basic phones, and basic life. If you want to leave this page right now, hear me out. Bare life isn’t a bad thing.

You can find peace, contentment, and happiness in basic.

It’s your attitude and perspective that bring about joy. We all know if we strip down the filters, happiness is not found in our stuff, appearance, or the image we portray to others.

So stop the upgrades, the must-haves. Don’t let your kids push you to believe they need everything new and now.

Be Patient

It would help if you were patient. Living a frugal life is like when you need to be honest with a friend but have to pray about it before you speak. Likewise, you need to be patient before you make a purchase.

While sitting back, working that muscle to think before you buy, you will give yourself time to find the best deal. If you wait, there will be a deal on whatever thing you need.

If you pray, there will be the exact item at the right price for that item you need. So please don’t get too excited about that car for only $1,000. Would you please make sure everything you are looking at functions and will fit the purpose you need it to?

Use What You Have

It’s pretty likely that right now, you probably have enough. But, unfortunately, we live in a culture where we go grocery shopping when our pantry and fridge are already full. So we add more and forget to see what we already have.

Groceries are a great way to live frugally. You can always make your meals at home by using what is in your pantry first.

Related:

Even if you see noodles, sauce, beans, and some fruit, you have a meal. Put aside your normal and look beyond to see what’s practical. The emotional side is a great thing to realize when learning to live a frugal lifestyle. So many times, our emotions lead us to purchases we don’t need.

Get Rid of Debt

Frugal people know that debt is a downer. It just lingers and pulls at you. The worst thing to do is ignore it and bury it further. Instead, you want to look at ways to cut back expenses so that you can pay off your debt.

Dave Ramsey’s plan was our game changer. You can learn about it here. In our culture, we look at others too much and buy their items. We think they must have money if they make a lot of big purchases. We forget that many people are financing this and adding another monthly payment.

Frugal folks know they don’t need a six-figure income to have room in the budget or live a peace-filled financial life. It’s all about not having debt.

Recognize When You Need Something & When You Want Something

Needs and wants are two different things. The items you talk yourself into are not needs. Do you need a brand new car for a new car? Why do you need a new car? Is it because of the social order it will put you in? It’s like fancy purses. Sure everyone enjoys a new purse.

Anything new is exciting and enjoyable. But why have a fancy purse when you don’t have any cash to put into it? Don’t let stuff cover up you. You matter. Your personality is what people remember about you, your relationships, not any of your stuff. So do not let your stuff slow you down.

I would keep track of everything you are spending. Or maybe look back at that room full of stuff and see what you really need and what you can get rid of.

Stop Using Your Credit Card

Oh, the big debate. I hear it now. “But you get so many points back.” Have you ever met someone making a six-figure say, “My credit card points got me here.” So let’s look at the facts.

Credit cards make it very easy to buy things to get points. Isn’t it more tempting to spend $20 extra bucks because you will get extra points for that plane ticket you want?

If you have the discipline to buy what you need and pay off your monthly credit bill, then OK, use it. But according to statistics, a tiny percent of us Americans have the willpower to walk away from the power of just throwing it on a plastic card. So instead, buy things with the money you have- CASH, Debit Card!

Invest Time

It is crazy how many things you can get for free or cheap if you invest time. I’m a coupon deal blogger, and I share freebies on my blog daily. I haven’t paid for a magazine subscription in five years. I’ve got the Wall Street Journal for free for almost an entire year.

You could get enough free samples of shampoo and deodorant that you don’t need to buy a whole jar. If things are tight and you are tired of living paycheck to paycheck- invest time to get something for less.

Take advantage of all the free information you have at your fingertips. If you have time, you can live on less and have so much more, my friend.

Check out Freebieshark.com, freestufftimes, and my deal blog here.

Don’t Eat Out- Unless You Have a Coupon.

Eating out for meals is a huge budget breaker. You can often have a healthier and cheaper meal at home for a lot less. If the thought of cooking meals sounds excruciating, start by only eating out if you have a coupon/discount to use. Follow websites that offer discounts on restaurants.

Make a schedule for those days when the coupons are good, and then plan the rest for meals at home. Even if you start with frozen prepared meals, it will be cheaper than eating. Start small. Then work your way down to only one night out a week.

If you need help with meal planning, you can use my favorite meal planning app here.

Budget for Every Holiday

Living a frugal life means you aren’t that person after Christmas who says, “Oh man I’m broke.” Instead, the holidays you celebrate throughout the year are at the same time every year.

We know that Christmas and our kid’s birthdays come yearly, right? So budget for them.

Keep your eye out for items throughout the year for holidays. Buy holiday items when they go on clearance for the following year. Always be prepared for these holidays, and you won’t break the bank for Christmas every year.

Change your Social Status

During this season of life, you may need to look closely at your circle of friends. When you are trying to pay off debt and not spend money, it’s not easy to get together at Starbucks with so and so even though you need a break from the baby.

You don’t have to end any relationships.

Just let them know you are serious about taking one step toward a more significant victory. That victory is debt-free living. Of course, they may not stay and hold your hand, and that is okay.

It would be best if you did this. Be careful scrolling through social media if anything triggers you to spend or gets you sidetracked thinking you can’t pull this off.

You can. You will.

Get Rid of Cable

Yep. Don’t try to let them convince you again that you can get a package deal. Who likes watching T.V. now with commercials?! I LOVE Netflix and Hulu. They are the type of programs where you stream your shows for $7.99 a month.

Hulu is great because you get to watch. T.V. shows the day after they air on the networks. The only downside is they do break for very quick commercials. However, you can upgrade your HULU account commercial-free.

Netflix is rocking it right now by offering their Netflix exclusive shows like Fuller House that are released a whole season at a time! This is the way of the future as many of these networks have their exclusive shows.

I highly suggest Amazon Prime- it works out to $7.99/month, and you do not just get to watch T.V. shows and movies. You also get two free days of shipping and deals just for Prime Members! Try Amazon Prime 30-Day Free Trial.

Related:

Cut Back the Amount of Meat You Eat

You don’t need to eat meat every night. You could eat canned meat every night. I’m thinking more along the lines of fresh meat. Fresh meat can be a grocery budget killer, so to save some cash, start by cutting it out twice a week.

Once you have a little freezer full of meats to fall back on, make it a point only to buy meat when it is sold or marked down. The great thing about finding meat marked down because it’s close to expiration is that you can cook it and freeze it right away.

Related:

Stop Buying Convenience Foods

That bottle of iced tea on your way home or that coffee on your way to drop the kids off at school. Anything that is convenience food is expensive and should be viewed as a treat. Little impulse buys to take you further away from your new daily goal-saving money.

It’s incredible what a lunch every day out will add up to at the end of the month.

Let’s say you buy lunch five days a week. You spend $10. That’s $50 a week and $200 a month. That is a good amount of money that would probably cover one of your bills or, better yet, could be applied to your debt. It’s easy to see a small number than to look at the bigger picture.

You may think that $10 is not a lot, but when it becomes a habit that you do without giving it thought, it looks like $200 a month of unnecessary spending.

Share Your Steps on Social Media

If you want to take this challenge to the next step, share your journey on social media channels. That way, you feel like you are being held accountable. You never know who you may inspire to take a closer look at their financial habits.

Don’t forget to reward yourself for those small steps you are taking. It’s good to celebrate along the way. You can do whatever you want out of life and reach higher.

Debbie Fox

Wednesday 5th of February 2020

I also had a struggling start in life but it sure does make you wise on budgeting. My husband and I don’t eat out much even though we can afford to . We go to Texas Roadhouse on their special nights and use gift cards we purchased on the holiday that gave us $30 more for each $100 we purchased.

Wendy

Tuesday 4th of February 2020

These are all Great tips. I need to work on getting rid of cable. We use credit cards only for travel, and pay them off as soon as we get the bill. We pay cash/checks for everything.

Thanks for all you do to help us save money. Wendy

Tasia

Wednesday 5th of February 2020

You will get there. Thanks for checking out all my websites Wendy :)